1. Moving the Markets

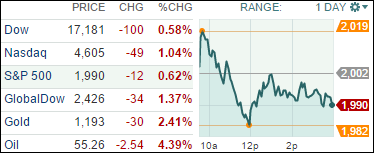

Markets continued to slide further downward today, driven lower in particular by the drop in oil prices and energy stocks. U.S. crude fell 3.3% to settle at $55.91, hitting fresh 5-1/2 year lows. Both U.S. crude and Brent have fallen nearly 50 percent from highs in June. Today, all major indexes retreated as the chart shows.

While oil and energy numbers were a drag, there is much to be optimistic about regarding other economic data. Among the day’s economic numbers, U.S. manufacturing output recorded its largest increase in nine months in November as production expanded across the board, pointing to underlying strength in the economy.

There is still a bit of earnings news left for us this week, particularly with food companies. We will hear from Darden (DRI), owner of Olive Garden and LongHorn Steakhouse amongst others. Investors have been anxiously standing by to see who the new CEO will be, as well as the anticipated 80% growth in profit for Q3. We’ll also hear from ConAgra (CAG) and General Mills Inc. (GIS). General Mills is still hoping kids love a bowl of cereal in the morning; however, their sales have been stale as sour milk recently. Wall Street analysts are anticipating an 8% decline for the quarter.

And in M&A news, shares of pet supply retailer PetSmart (PETM) rose 4.2% after it agreed to be bought by a private equity consortium led by BC Partners Ltd for $8.7 billion, in the largest leveraged buyout of the year. Woof woof!

In a repeat from Friday’s downturn, our International TTI confirmed its trend reversal and is now in “Sell” mode. On a personal note, there has been no effect on our holdings, since we had no exposure; you may recall that I have from time to time posted my aversion towards international equities, especially Europe.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

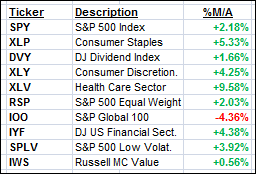

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For additional ETF selections please review my weekly StatSheet, which is updated and posted every Thursday night.

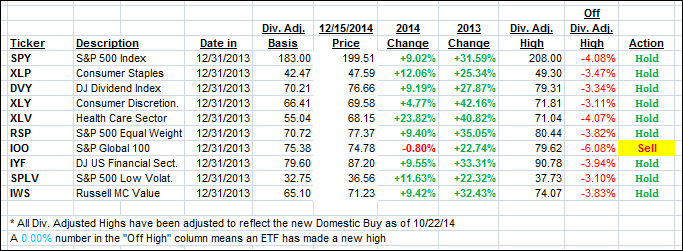

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south again with the International one now confirming its move into bear market territory. Domestically, we are remaining on the bullish side but upward momentum has slowed considerably and weakness has set in.

We will have to wait and see if the Domestic TTI will break its trend line to the downside. If so, then the entire rebound from the middle of October, caused only by Fed governor Bullard’s jawboning about possibly extending QE4, will have been one gigantic dead cat bounce.

Here’s how we ended the day:

Domestic TTI: +1.27% (last close +1.82%)—Buy signal since 10/22/2014

International TTI: -2.70% (last close -1.60%)—New Sell signal effective 12/15/14

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 3

Dear Ulli,

First, thank you for all you do, and thank you for making your analyses, obviously obtained at great cost and effort by you, available to all of us free of charge. You have helped me greatly over the years (since 2009) that I’ve been following you.

But with the Domestic TTI approaching sell territory, I am concerned about another whipsaw, as I am sure you are too. Is the move since mid-October a dead-cat bounce, or is this decline another bearish feint in a long-term bull market?

Jack Schannep, whom I’ve been following for the past few months, is rated by Hulbert as one of the very best timers. He asks in his Nov. 29 letter, “Did the recent market weakness ‘trick’ anyone you know?” (meaning the October drop). Well, it did trick me, and I recall that he flashed a warning but his methodology avoided a sell signal at the last minute. It’s a quite complicated method based partly on Dow Theory, but a lot goes into it, and I want to ask if you are aware of it, and if you have any comments that you could share with us without revealing the proprietary aspects of your own TTI approach. He goes into a lot of detail about his method, laying out each decision in a step-by-step fashion, so it would be easy for you to evaluate it, although you would have to be a subscriber.

Thank you for all you do, and thanks in advance for any answer you can offer to my question.

Best, Mel

Hello Mel,

Sure, another whip-saw is always a possibility. I recall that during extreme volatile times in the market place over the past 25 years, I have seen a whip-saw signal more often than not prior to the onset of a severe bear market.

I look at my exit strategy as my insurance policy. Personally, I have insurance on my house, my car, my health not because I expect it to be used but more so to be covered in case a major disaster strikes. I apply that same theme to my investments. I know that at times whip-saw signals occur, and I have learned to simply accept them for what they are. Trying to apply a different rule based on the personal interpretation that this sell-off may be different can backfire big time, as no one can ever be sure whether the bear is about to strike and wipe out years of portfolio accumulation.

I like to keep the strategy of exiting and entering the markets as simple as possible since that very approach has served me well in avoiding the brunt of the severe market downturns we’ve seen over the past 25 years.

Ulli…

Dear Ulli, Thank you for this very thoughtful reply, Mel