1. Moving the Markets

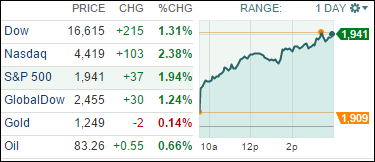

The markets continued to rally Tuesday after a big Q3 earnings report from Apple (AAPL) after the closing bell yesterday. The S&P 500 gained 1.94%, the Dow rose 1.31% and the Nasdaq led the pack rising 2.38%.

Earnings reports from five Dow companies came in mixed this morning before the opening bell. Coca-Cola (KO), McDonald’s (MCD) and Verizon (VZ) fell shy of estimates, while insurance company Travelers (TRV) and United Technologies (UTX) beat forecasts.

Markets got an added huge assist in Europe when there was talk of the ECB considering buying corporate bonds. Germany’s DAX stock index was up 1.9%; shares were up 2.3% on the CAC 40 in Paris and 1.7% higher on the FTSE 100 in London. Things weren’t as peachy in East Asia. Markets were down today after China reported its weakest economic growth in five years.

It seems the mood on Wall Street is slowly improving as the focus shifts to corporate fundamentals such as earnings and economic data, which continue to brighten.

For more details on how today’s rally affected our Trend Tracking Indexes (TTIs), please see section 3 below.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

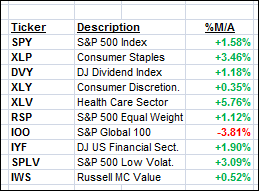

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

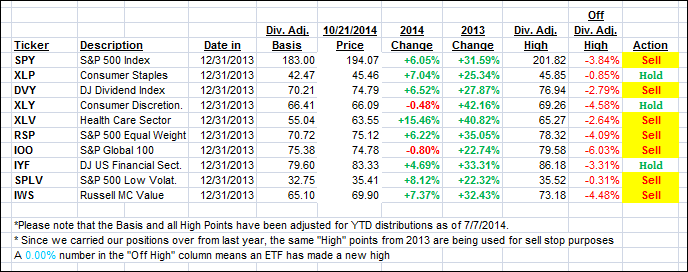

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

The “Action” column has been modified to show the effects of our Sell signals. The current “Hold” positions reflect only sector ETFs, which should be sold based on their respective sell stop points.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) shifted in reverse as the rally, which started last Friday, gained momentum and powered our Domestic TTI back into bullish territory. While I personally view these quick directional changes with great suspicion, we nevertheless crossed the long-term trend line to the upside by a substantial margin.

That means I will start to ease into new positions tomorrow, unless the market greets me with a major sell-off. If so, I will hold off another day with making new commitments. In the absence of a pullback, I will consider tomorrow the beginning of a new Domestic Buy cycle.

I will not invest 100% of assets but make incremental purchases and add to them as the rebound rally confirms that further allocations are warranted.

At this time, it’s clear that we just experienced a whip-saw signal. While they do happen from time to time, this “Sell” period was very short in duration, the like of which I have not seen since the tech bust in 2000.

Nevertheless, it is what it is, and we have to acknowledge that we simply went the safe way and stood aside in what could have been a potential market disaster.

Here’s how we ended up:

Domestic TTI: +1.26% (last close +0.30%)—Sell signal since 10/14/2014

International TTI: -2.97% (last close -4.09%)—Sell signal since 10/1/2014

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 6

So is this considered a BUY signal? You allude to it being a BUY signal but do not really say that it is in Item 3 of your post.

Thanks

Dear Ulli, Does a whipsaw like this lead you to rethink the rules at all? Thanks for all you do, Mel

John,

This this is what I said:

“That means I will start to ease into new positions tomorrow, unless the market greets me with a major sell-off. If so, I will hold off another day with making new commitments. In the absence of a pullback, I will consider tomorrow the beginning of a new Domestic Buy cycle.”

The pullback did not happen, so the new buy cycle is on.

Ulli…

Hi Mel,

No, there are no changes to my rules. It’s impossible to come up with a perfect investment scheme. They all have their issues in different market environments, as I have witnessed over the past 25 years. Getting a whip-saw from time to time is the risk we take in order to avoid participating in huge down market disasters.

Ulli…

In following the 7.5% rule, I cashed in my mutual fund shares at about 8%. Being reluctant to get back in over the last week, I missed a complete upside return to where I was when I got out.

The problem with mutual funds is that they don’t like you redeeming your shares and then returning to the market every other day or so. My apprehension kept me on the sidelines and have paid the price.

Your input regarding this problem in dealing with mutual funds.

Thanks.

Dick,

Yes, that’s been an old problem that we avoid by using ETFs. I manage a few 401k accounts for clients, where mutual funds are mandatory, and we predominantly use the equivalent index fund for the S&P 500. Since a whipsaw does not happen very often, this has not been a issue for us.

Ulli…