1. Moving the Markets

Stocks ended mostly lower today, continuing on the down-slide from a sub-par performance last week. The S&P 500 dropped a slight 0.08%, the Dow gained 0.26% and the Nasdaq lost 1.06% on the day.

The focus on interest rates remain front and center this week as markets anxiously await the outcome of the Federal Reserve’s two-day meeting that starts tomorrow. Results of the meeting should provide some solid indication as to whether a recovering economy will lead to interest rate hikes.

Other big news in focus this week will be Scotland’s vote on independence, which will take place on Thursday; as well as how the Alibaba IPO is going to play out. If you didn’t know, Alibaba plans to increase the size of its U.S. IPO because of “overwhelming” investor demand. Alibaba could set a new record for the world’s biggest IPO if underwriters exercise an option to sell additional shares to meet demand, pushing it as high as $24.3 billion and overtaking Agricultural Bank of China Ltd’s $22.1 billion listing in 2010.

Overseas, Russian stocks and the ruble fell with the currency dropping to a record as the U.S. and European Union toughened sanctions against the country last week

3 of our 10 ETFs in the Spotlight advanced, while 1 remained unchanged and 6 of them closed lower.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

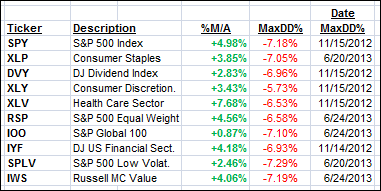

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

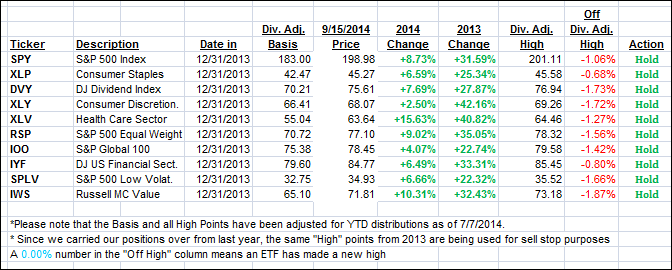

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) edged lower and closed as follows:

Domestic TTI: +2.03% (last close +2.14%)

International TTI: +1.35% (last close +1.60%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli