1. Moving the Markets

The major indexes managed to eke out a small gain following a wild ride as a result of the Fed’s pledge to keep interest rates low for a “considerable time,” while ongoing concerns about “underutilization” in the labor market remain.

No timetable for higher rates was announced, however, it appears that hikes may come at a pace, which may be quicker than expected and forecast. The dollar jumped against the euro while financials ended up being one of the better performers for the day.

Immediately following the Fed’s statement, equities dumped, then recovered and dumped into the close again. That wild ride confirms the sensitivity of the indexes trying to justify these lofty levels, which have been reached not because of sound fundamentals but merely because of the Fed’s accommodating stance over the past few years.

5 of our 10 ETFs in the Spotlight managed to close up during this roller coaster ride with 1 of them making a new yearly high.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

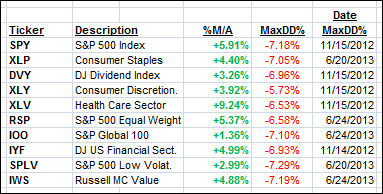

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

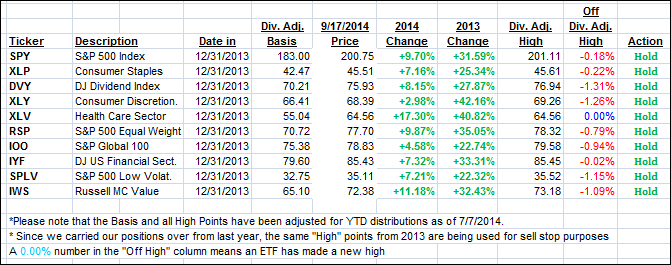

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed and closed as follows:

Domestic TTI: +2.32% (last close +2.39%)

International TTI: +1.30% (last close +1.63%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli