The ETF/No Load Fund Tracker

Monthly Review—October 31, 2013

Euphoria Drives US Stocks Near All-Time Highs In October

US stocks finished higher in October amid speculation the Federal Reserve would withdraw its stimulus by as early as January and despite a prolonged government shutdown at the beginning of the month that threatened to derail the nation’s economic recovery.

The blue-chip Dow Jones Industrial Average ended up 2.8 percent for the month.

The S&P 500 index finished at 1,757, adding 4.5 percent for the month while the tech-heavy NASDAQ Composite Index closed out at 3,920, up 3.9 percent for the month.

These gains made it the best October for equities in three years across the board. Equity analysts, however, speculate the market is ready for a pause after a strong showing.

The ongoing earnings season continued to paint a mixed picture of the economy with about 68.5 percent of S&P 500 companies topping Wall Street expectations, well above the long-term average of 63 percent. However, only 53.5 percent topped revenue forecasts, missing the 61 percent average recorded since 2002.

Among major economic developments in October, the US Fed released the year’s policy statement, keeping its interest rates and assets-purchase program unchanged as expected. The world’s largest central bank acknowledged fiscal policies are causing headwinds to the economy and noted the recent slowdown in the housing sector. What caught the market’s attention, though, was the omission of the term “tightening fiscal conditions” that appeared in the September policy directive. Markets perceived this omission as somewhat hawkish as the FOMC didn’t change its forecast to account for the impact from the government shutdown, and were caught slightly off guard.

Factory activity in the US remained strong for the month with the Chicago Purchasing Managers’ Index coming in at 65.9, marking its best performance since March 2011 and handily beating expectations for a reading of 55. The constituents of the benchmark were equally strong with order backlog, new orders and production indexes posting double-digit growth.

The September nonfarm payroll report, delayed due to the partial govt. shutdown earlier in the month, was a cause for concern. It showed the economy just created 148,000 jobs compared to the 193,000 in August. Nonfarm private payrolls increased by a dismal 126,000 in September compared to a 161,000 gain in the previous month.

The political morass in Washington took its toll on consumer sentiment. The final reading of the University of Michigan/Thomson Reuters Consumer Sentiment Index fell to 73.2 from an earlier estimate of 75.2 and was nearly 10 points lower than the September reading.

Across the Atlantic, European stocks surged in October with the pan-European Stoxx Europe 600 index rising 3.8 percent for the month.

The real economy however, painted a different picture. European labor markets continued to suffer with unemployment rate in the euro area hitting a record 12.2 percent in September. Brussels-based Eurostat revised August’ unemployment rate upwards to 12.2 percent from the previously estimated 12 percent.

Inflation in the single-currency region fell to the lowest level in nearly four years in October. The European Central Bank will be under pressure to cut interest rates and ease money supply to support the region’s struggling economy when it meets this week for policy decisions.

Prominent European equity indexed posted robust gains for the month. UK’s FTSE 100 added 4.2 percent in October while Germany’s DAX 30 index picked up 5.1 percent.

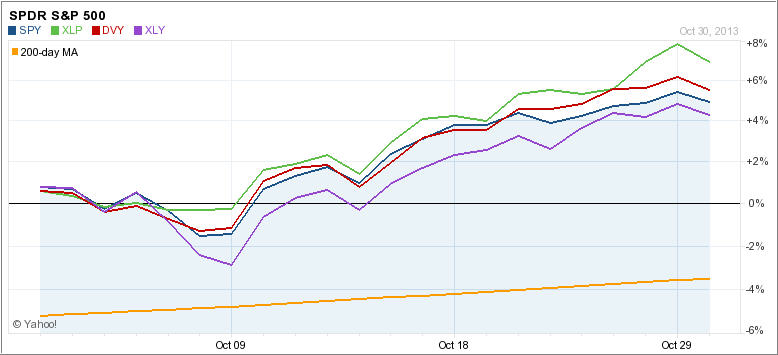

Our major holdings picked up some steam during the month of October, especially Consumer staples (XLP), which gained some 6.5%; yes that is in one month. Take a look at the chart:

XLP was the top performer during the first few months of this year; it then underperformed during the summer months before picking up the slack and shifting into overdrive. I believe that our current combination of ETFs will serve us well in the intermediate future.

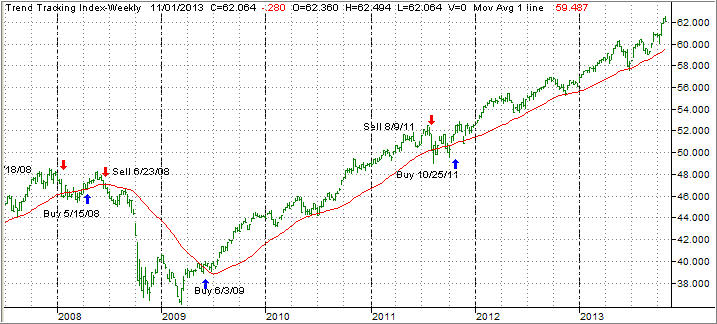

Our main directional indicator, the Domestic Trend Tracking Index (TTI) kept pace with the major indexes and remains solidly on the bullish side of the trend line, as the chart shows:

We have successfully made it through the historic bull market killer months (September/October), and are now entering the seasonally strong period for equities. I do like to point out that, due to the Fed’s policies, the markets are manipulated and pushed to current record highs artificially and not due to underlying fundamental strength.

However, as trend followers we really don’t care what causes the markets to go up as long as they do go up. But, it also means, the possibility of a sudden market reversal will always be with us, so we have to continuously be on guard in case the euphoria comes to an end all of a sudden.

Contact Ulli