I did not think it was possible that the markets were actually able to lose a face-off with gravity after their relentless and almost uninterrupted ascent since mid-November. Even the by now well documented afternoon “lift-a-thon” was notably absent, as the major market indexes took their cue from Europe and produced their worst loss of this year.

Certainly, a correction was long overdue since this current trend is simply unsustainable; however, the trigger point causing this uncertainty was Europe, or more specifically rising Italian and Spanish bond yields caused by the corruption scandal in Spain along with hidden Italian bank losses and cover ups.

Well, I for one am glad to hear that Europe is fixed as the main stream media have been jaw boning about for the past few weeks. Now, all of a sudden, the sovereign debt crisis has gained momentum again as investors realized that nothing has been resolved; issues have been merely postponed.

The European markets took it on the chin, as the following chart shows:

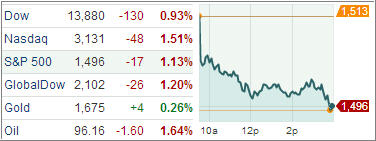

[Chart courtesy of MarketWatch.com]It was straight down all day, and the US markets simply followed suit. Both, the Dow and the S&P 500 surrendered their recently conquered milestones (14,000 and 1,500 respectively) as bearish forces simply proved too powerful today.

Domestically, the US Commerce Department reported that factory orders for December came in below expectations, helping the bears to dig in.

Our Trend Tracking Indexes (TTIs) retreated as well with the Domestic TTI now hovering at +2.70%, while the International TTI has moved to +10.65%.

It’s too early to tell if today’s reversal has any legs and will move the indexes closer to reality. Again, a simple correction has been long overdue, and some analysts are looking for a pullback in the 3-5% range.

Contact Ulli