The ETF/No Load Fund Tracker—Monthly Review—January 31, 2013

Equities End January With A Bang; Europe Rise On US Economic Data

US equity averages saw broad gains as December’s last-minute budget deal, to avoid the so-called fiscal cliff, and a wave of economic numbers in January ensured more money flowed into equity funds than bond funds for the first time since 2007.

The benchmark S&P 500 jumped 5 percent for the month, hitting its highest level since December 2007 and marking its best January since 1997 when it added 6.1 percent. The benchmark index finished with a gain in 13 out of 21 sessions for the month.

Of course, let’s not forget that the main driver for this parabolic rise was not the underlying economy but merely the reckless money creation by the Fed at the tune of $85 billion a month. At that rate, it‘s only logical that some of that money finds its way into the stock market.

As we saw, much of the economic data released during the month came up short. Five out of seven January reports fell short of expectations.

Employment, the most crucial indicator on the economy’s health, remained a sticky issue. The economy added a modest 157,000 jobs in January, falling short of the 170,000 forecast by analysts, while the unemployment rate ticked up 0.1 percent to 7.9 percent. The hiring pace in January showed businesses are somewhat cautious about taking on new employees amid a weak growth outlook, a hike in US taxes and the continued budget wrangling in Washington over the crucial debt-ceiling issue.

But more importantly, the rise in the unemployment rate means the Federal Reserve is unlikely to curb its bond buying program any time soon. Also interest rates are likely to be held at ultra-low levels until the jobless rate falls to the Fed’s stated target of 6.5 percent. Consumer spending accounts for 70 percent of the US economy, and the Fed wants to make it easier for people to buy homes, cars and other big-ticket items.

In other words, while more fuel to continue the rally is being generated, it’s questionable in my mind, how long this disconnect between stock market levels and economic fundamentals can continue. Sooner or later, this difference will matter and either the economy picks up steam enough to justify the recent rally or the market indexes come back down to align with reality.

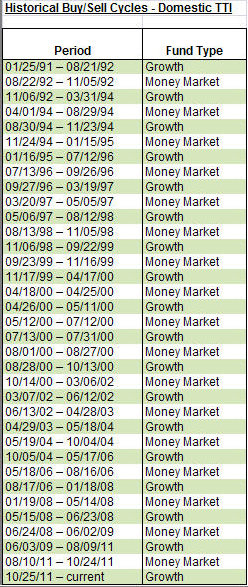

Our main directional gauge, the Domestic Trend Tracking Index (TTI), headed higher and is now positioned as follows:

As of last Friday, the TTI (green line) had rallied above its long term trend line (red) by +3.10% indicating a strong bullish position.

With the market indexes and our TTI being at multiyear highs, my preference remains to be balanced in our approach and not be recklessly exposed to equities only. While equity only exposure can have its rewards, it is a risky proposition given the fact that the only reason we are in nosebleed territory is due to monetary stimulation by the Fed.

I have mentioned it before, but it’s worthwhile repeating. None other than the NY Fed itself stated last December that the S&P 500 should be trading at a level of 700 (current level is 1,500) were it not for the variety of stimulus programs enacted over the past few years.

During this past month, I increased our holdings in Real Estate Trusts (VNQ) and Consumer Staples (XLP), both of which have performed well in the past but have also held up fairly well during market pullbacks.

The same applies to the Dow Jones Dividend Index (DVY), which was also added again to our current menu. Rounding out our exposure were additional bond purchases in BOND and PONDX.

We are now having primarily balanced portfolios with bonds providing a temporary buffer against equity declines; of course, our trailing sell stops will be our ultimate risk protection as I believe that continued market manipulation by the Fed will have unintended consequences with the big one being a sharp hit to equities and eventually to bonds.

However, as long as the rally goes on, we will participate, but I am well aware that there is a limit to this euphoria, and I am prepared to exit should the need arise.

Contact Ulli