The ETF/No Load Fund Tracker—Monthly Review—May 31, 2012

The ETF/No Load Fund Tracker—Monthly Review—May 31, 2012

Major Market Indexes Shift Into Retreat Mode

US stocks fell sharply in May as the ADP payroll report showed employers added only 133,000 jobs in May versus a consensus estimate of 157,000.

The blue-chips Dow Jones Industrials broke its winning streak and closed the month lower for the first time in 2012. Stocks hit the lowest level in two-years with the S&P 500 shedding 10 percent from the peak it reached two months ago on the last day of the month.

Markets remained volatile with a negative bias throughout May, as Greece continued to dominate world headlines. US domestic economic news was lackluster with the first quarter GDP growth revised downwards to 1.9 percent. Economists had thought the preliminary 2.2 percent reading will be revised down to 2 percent. The weekly jobless claims in the final week of May jumped to 383,000 against a forecasted 368,000. Pending home sales data also failed to cheer, contracting 5.5 percent while a 0.6 percent growth was broadly expected.

The Chicago Purchasing Managers Index, a barometer of manufacturing activities in the Midwest, slipped to 52.7, its lowest level since 2009 and the third consecutive down month.

Treasuries clearly emerged as investor favorites as risk remained off the table. The 10-year benchmark Treasury yield touched a new all-time low as demand for US safe haven assets surged. China came under focus as the dragon showed signs of a slowdown. The rising yields of Spain and Italy didn’t help investor mood either with some economists now suggesting Spain may be the first to leave the eurozone before Greece.

The Spanish banking sector continues to pose a major threat to the global recovery. Spain’s banks may require upward of $100 billion to stay afloat. The recently nationalized Bankia Group failed to secure a $23 billion bailout package from the European Central Bank, raising fears of an unprecedented run on the region’s banks.

Though there was near bloodbath in the equity markets in May, the defensive sectors— particularly Telecom and Utilities, performed well and managed to limit their losses.

Nevertheless, our International Trend Tracking Index (TTI) dropped sharply generating a ‘Sell’ signal effective 5/15/12, as the chart below shows:

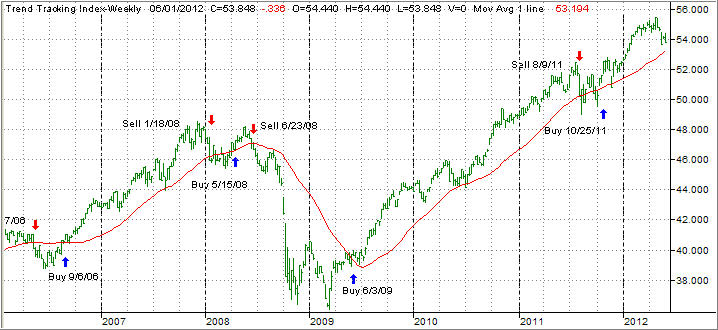

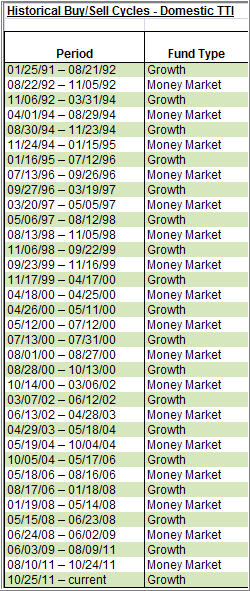

As a result, we no longer hold any positions with international flavor. Domestically, the situation worsened as well in regards to trend direction, as our Domestic TTI came down sharply but managed to stay above the dividing line between bullish and bearish territory. Here’s the latest chart:

Some of our trailing sell stops were triggered (VTI) while other domestic holdings (DVY) resisted the trend and kept us in the market—so far. Another 2% drop in DVY, and we will be exiting this position as well.

Several of our Model ETF portfolio are now showing a better performance YTD than the S&P 500, which went from +12% at the end of the first quarter to a meager +1.63%, and that is in danger of turning negative.

My preference has been to be closely aligned with Model Portfolio #2 which, even without equity exposure, let’s us participate in the various bond rallies, as the worldwide hunt for safety has pushed US bonds/treasuries higher.

The month of June will be critical for global markets. For one, Greece votes for the second time this year to elect a government. However, in reality it would be a referendum on the single-currency.

If the Greeks reject the previous government’s austerity commitments, this could very well mean the end of the road for Athens in the EU. If a Greece exit becomes a reality, then containing the resulting contagion fear will be the biggest challenge for the European leaders, and Spain and Italy remain most vulnerable.

Of course, it’ll be logical to believe that the Federal Reserve and the European Central Bank has a contingency plan in place and expect markets to be flooded with short-term liquidity to ease the panic attack. Also the Chinese government may announce stimulus measures to prevent a further slowdown.

As in the past, I believe these are measures that will temporary boost equities but will fail miserably in solving the true underlying crisis, which is one of insolvency and not lack of liquidity.

It’s therefore imperative that I stick to our sell stop discipline by discarding those holdings that are slipping into bear market territory. Once European contagion breaks loose, the exit doors may get very crowded very fast, so it pays to be a day early rather than a day late.

Contact Ulli