U.S. stocks ended lower Monday despite the service-sector gauge advancing in February. The Institute for Supply Management’s non-manufacturing index came in better-than-expected. However, its employment index dropped, while the inflation-measuring price index jumped in January.

Not helping the markets were the Chinese lowest growth target in eight years for 2012 and a survey that showed a shrinking European economic activity.

The Dow Jones Industrial Average shed 0.1 percent while the S&P 500 (SPX) lost 0.4 percent after natural resources retreated and consumer staples advanced. The tech-laden NASDAQ Composite was leading to the downside by dropping 0.9 percent.

Treasuries fell after U.S. service industries’ index recorded its fastest growth in a year, reinforcing the domestic recovery theory.

Also Greece’s announcement that it expects private creditors to accept the bond-swap helped after reports appeared over the weekend stating some private investors may reject the excessive write-downs of their bond holding. The Yield on 30-year Treasury bonds rose four basis points to 3.14 percent.

The iShares Barclays 20 Year Treasury Bond ETF (TLT) slipped 0.79 percent while the Vanguard Total Bond Market ETF (BND) shed 0.20 percent over Friday.

After getting hammered for most of last week, futures-tracking natural gas ETFs started diverging sharply today. The iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ) topped the winner’s list after jumping 4.98 percent on the day.

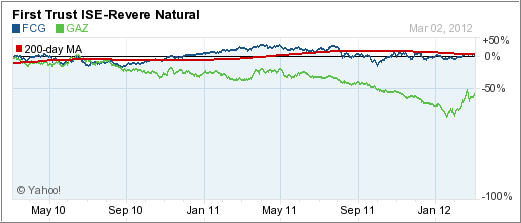

According to reports appearing in the WSJ, Chrysler may soon launch a pickup powered by natural gas. If you are looking to cash-in on the energy sector, should natural gas gain traction in future, equity-based products such as the First Trust ISE Revere Natural Gas Index Fund (FCG) look a lot less volatile as the comparison chart shows:

[Chart courtesy of YahooFinance]The Market Vectors Vietnam ETF (VNM) continues to sizzle and soared 3.27 percent on the day, its third straight day of gains. VNM’s downfall at the end of February is increasingly looking like a short aberration confirmed by the recent break above its long-term trend line.

Among the day’s top losers, solar-energy focused products continued to languish with the Market Vectors Solar Energy ETF (KWT) shedding 4.75 percent for the day. The Guggenheim Solar ETF (TAN) is also out of favor by being stuck in bear market territory.

Both base and precious metals are heading south as markets remained choppy globally. The Global X Copper Miners ETF (COPX) dropped 3.59 percent while iShares Silver Trust (SLV) lost 2.16 percent in early afternoon trading.

Oil ended near flat with prices for April delivery adding six cents to $106.75 a barrel.

Gold futures for April delivery shed $5.90 to close at $1703.90 an ounce.

Our Trend Tracking Indexes (TTIs) retreated slightly but remain safely above the dividing line between bullish and bearish territory.

Disclosure: Holdings in BND, TLT, GLD

Contact Ulli