The ETF/No Load Fund Tracker—Monthly Review—February 29, 2011

The ETF/No Load Fund Tracker—Monthly Review—February 29, 2011

Major Market ETFs Maintain Upward Momentum

February started on a strong note after some January economic reports came in stronger than expected, driving both the DJIA and the S&P 500 to multi-month highs. The NASDAQ went on to touch its best level in a decade.

Fed Chairman Bernanke testified before the House of Representatives Budget Committee, and his statement that the economy is susceptible to shocks surprised no one. Even as Greece struggled with the second bailout round, concerns over Europe and domestic economic outlook were on the decline, he noted.

The gridlock over Greece spilled to the markets next week as aggressive selling was witnessed on Monday and ensuing losses made sure markets booked losses, snapping a streak of five weekly gains. However, by Thursday the market had accumulated modest gains made on Tuesday and Wednesday and the S&P 500 ended at its highest level in seven months.

Domestic upward momentum affected the international arena as well, as our International Trend Tracking Index (TTI) finally crossed its long-term trend line to the upside and generated a ‘Buy’ signal for that area effective February 8. I took the opportunity to add VEU (Vanguard All World-ex. U.S. index) for some clients, while for others I already had covered that slot with a couple of well performing country ETFs.

As uncertainties over Iran continued, oil prices continued to climb before closing at a multi-month high of $109.76 per barrel. The rise in oil prices drove the CRB Index 2.7 percent higher for the week. Along with Tech stocks, Utilities, Energy, Healthcare and Consumer Staple advanced while Financials and Telecom declined.

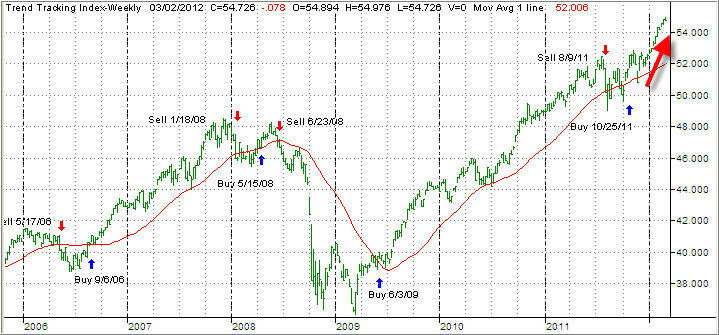

The final week saw some action with commodities tumbling though the S&P 500 managed to end the week higher for the eighth time in nine weeks. Our Domestic Trend Tracking Index (TTI) followed suit and has been ascending in a straight line since the beginning of the year (red arrow), as the chart below shows:

It’s glaringly obvious that this steep ascent can’t continue, because it has been supported primarily by loose monetary policy. Sooner or later some reality has to set in, and the question remains in my mind as to how much of a setback the markets will have to deal with.

While no one has that answer, or knows the timing of it, it simply pays to be alert to any directional changes, and I am prepared to deal with them via our trailing sell stops designed to limit downside risk.

In the meantime, Fed Chairman Bernanke delivered his semiannual monetary policy report on the last working day of the month. Though his observations weren’t surprising, his skipping a reference to future quantitative easing (QE3) definitely surprised many. It seems to me that QE3 had been priced in the market and any lack thereof, along with possible weakening economic numbers, could very well be the impetus to end this euphoric rally all of a sudden.

Contact Ulli