With over 1,000 ETFs now making up the universe, there is bound to be some redundancy.

With over 1,000 ETFs now making up the universe, there is bound to be some redundancy.

If you cut down this large ETF pile and select only those with high average daily volume figures, which I define over $10 million, you end up with less than 100. Even in that much smaller pile there are duplications, which are necessary for healthy competition.

With all things being (almost) equal, how do you then make your selections?

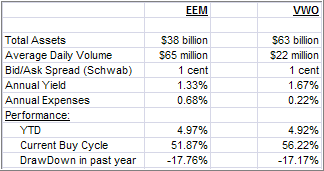

Let’s take a look at 2 ETFs, which are the heavyweights in the Emerging Markets arena, namely EEM and VWO. Here’s a little matrix I use to make a quick comparison, after having looked at the momentum numbers and rankings, to see which ETF might be the better choice:

[Click on table to enlarge]Years ago, EEM used to have higher net assets, but that has changed as VWO has raced ahead. Strangely enough, EEM’s daily volume exceeds their total assets, while VWO sports a volume sufficient for almost any investor.

The bid/ask spread is identical, the annual yield favors VWO and on the performance side, the differences are fairly small.

In this case, it comes down to the annual expenses where VWO is the clear winner with less than 1/3 of what EEM is charging. That’s why VWO is the preferred choice in my advisor practice.

Contact Ulli

Comments 5

Ulli: Thanks for your posts. EEM trading volume and AUM are nowhere near equal. One is in millions and other is in billions. Regarding DBC, did what we experience is a whipsaw and do we again get back on it or let it go.

Thanks.

Ano,

Yes, you are correct with the volumes, which for my comparison purpose did not matter as much. The lower fees are more important. Nevertheless, it appear that this is my week of errors…

In regards to DBC, for right now, I’ll let it go. It’s too volatile to jump back in after a 2% gain. I may consider it again for the Ivy portfolio once it takes out its old high.

Ulli…

Ulli: Many thanks for your kind response. You are always prompt in responding.

Where can I find only the 100 ETFs with high average daily volume figures?

Donald,

You can’t find them on my site. So far, they have only been for office use only and no reporting capabilities have been set up.

Ulli…