Yesterday, the markets staged a major rebound with Dow gaining almost 400 points in very similar fashion to a few weeks ago. The big question remains now if this was just an April Fools’ joke or the real recovery many have been hoping for.

Yesterday, the markets staged a major rebound with Dow gaining almost 400 points in very similar fashion to a few weeks ago. The big question remains now if this was just an April Fools’ joke or the real recovery many have been hoping for.

We’ve seen these head fakes not too long ago on both, the upside and the downside. The moves were usually just large enough to bring in enough participants eagerly hoping that the train will continue in the direction it started. So far, every attempt has been a disappointment, however, sooner or later a real trend will materialize, as I posted about yesterday.

For some assistance, let’s look again how our Trend Tracking Indexes (TTIs) closed out the monster day:

Domestic TTI: +0.60%

International TTI: -3.96%

While these numbers represent a great improvement from yesterday, the moment to make a new commitment has not arrived yet. Again, as we’ve seen, when the TTI momentarily broke to the downside by -1.64% a few weeks ago (for one day only), some eager investors jumped in with short positions, which are now not looking so good. The same can happen to the upside.

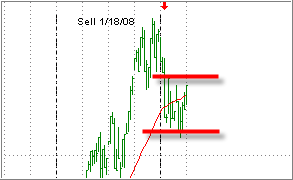

I found over the years that, in order to limit those whipsaws, it’s best to be a little late entering the market by making sure a directional breakout has really occurred. How can you do that? Let’s take a look at the top portion of the domestic TTI chart:

Note that for most of 2008, we have been trading in a large sideways pattern (between the red lines) and therefore have been stuck in what I call a neutral zone. Once we break out either below or above, the odds are greatly enhanced that a new trend with legs has started.

To put more concrete numbers on these lines, I have marked this neutral zone as an area defined by an upper range of +1.5% above its trend line and a lower range of -1.5% below its trend line. Once either is pierced and the price holds, I will take that as an opportunity to enter the domestic market again either on the long or the short side.

However, keep in mind that this is not an exact science but simply my experience of what has worked for me in past to minimize frustrating whipsaws.