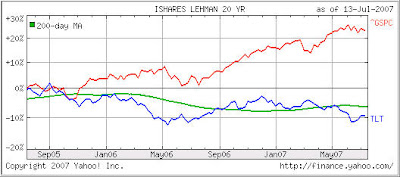

Last week’s solid rebound rally happened despite higher oil prices and interest rates. Generally speaking, interest rates and stocks tend to move in tandem, which has not been the case lately. Take a look at the chart below, which shows the iShares Lehman 20+ Year Treasury Bond ETF (TLT), vs. the S&P; 500:

Notice that the gap between the two has been widening since the end of 2006, which means that, as interest rates rose, bond prices fell. Long-term, this is not sustainable as stock investors at a certain point will switch to higher yielding and safer bonds (as in ‘perceived’ safety) from the more volatile stock market environment.

While there is no exact number in regards to a desirable bond yield for investors to make the switch, my point is that an adjustment will happen; the timing is just unknown. That can either be in the form of lower interest rates (good for stocks) or lower stock prices (higher interest rates), the former which would be more desirable.

The good news is that, when using trend tracking, we don’t have to concern ourselves with the “when” and “why” since our exit strategy will tell us when it’s time to take some chips of the table.