A question came up in my advisor practice as to whether REITs are still a good investment given the current market climate.

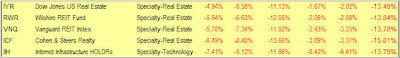

If you look at the sector section of my latest StatSheet, you’ll notice that all domestic Specialty Real Estate ETFs are listed at the bottom based on their 4-wk performance figures as shown below (double click to enlarge):

My managed account clients currently have no holdings in any of these funds since we sold our positions when our sell stop got triggered on 3/6/2007.

As you can see, all momentum figures are very negative, and, if you follow trends, there is no reason to be involved in any of the above at this time.

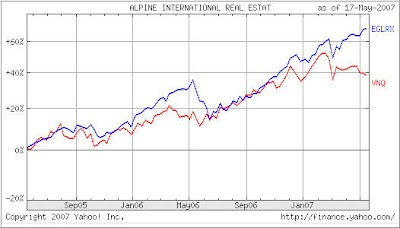

However, that does not mean this applies to all Real Estate funds. If you look at the international market place, the picture looks different. The chart below shows a comparison between VNQ and EGLRX, a REIT that invests only outside the U.S.:

You can clearly see the “disconnect” between the domestic and the international market. It appears that the divergence took place right after the one-day meltdown on 2/27/2007 after which the domestic Real Estate market never recovered.