A couple of weeks ago, I was looking at utility ETFs to diversify some of my clients’ money into this well performing sector.

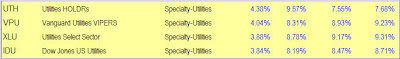

In my weekly StatSheet, I have been tracking four of them on a regular basis. If you look at the table below, you’ll notice that all have very similar momentum figures in the categories of 4Wk, 8Wk, 12Wk and YTD:

Sure!

In this case, I was concerned about placing 2 good sized orders (over $500k each) over a couple of days at a limit price and without affecting the NAV adversely. To do that, you need to look at the net assets of the ETF along with the average daily trading volume. Here’s what I found:

UTH: Average Daily Volume: 219,000 shares, Net Assets: $433 million

VPU: Average Daily Volume: 24,000 shares, Net Assets: $194 million

XLU: Average Daily Volume: 3.9 million shares, Net Assets: $2.98 billion

IDU: Average Daily Volume: 76,000 shares, Net Assets: $820 million

For me, the decision was easy. Since I was about to trade almost 30,000 shares, XLU with its incredible volume was the clear winner. This is not to say that you could not have picked any of the others but, when dealing in large volume, you need to concern yourself with liquidity.

Sector ETFS, as well as sector mutual funds, are notoriously volatile and, when everybody heads for the exit door at the same time, liquidity can make all the difference in you selling your positions without too much slippage in price. And that can mean the difference between a profit and a loss.