Lately, a frequently asked question in my advisor practice has been related to real estate.

Last week, the government reported that new homes sales fell 17% last year — the worst decline in 16 years.

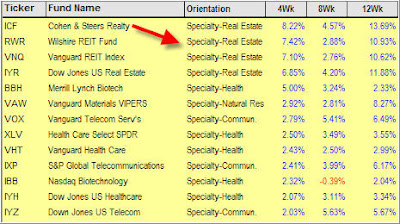

However, sector real estate funds/ETfs gained on the day. In fact, the leader of the sector listings in my newsletter, based on a 4wk sorting, was real estate, as you can see from the following table:

All sector real estate mutual funds/ETFs invest in REIT’s, which in turn are exposed to commercial and industrial properties and not residential ones. With the economy humming along just fine, based on the performance of the stock market, commercial real estate has rallied sharply due to higher demand and other factors.

Will this go on forever? Of course not. That’s why, for all of our positions, we have trailing stop loss points set up to protect ourselves from the downside whenever this market reverses its trend.

This may not be in the near future, but you have to be ready to act whenever the facts change.

Contact Ulli

Comments 4

Ulli, do you allocate a certain portion, or percentage, of your portfolio to real estate equities and maintain RE funds in the portfolio during a buy cycle…

or…

do you only include RE if the individual funds that you track meet your momentum and drawdown criteria as opposed to all others during a buy cycle like the one we are currently in?

Just wondering,

G.H.

GH,

Depending on momentum figures, I allocate about 5% of portfolio value to such real estate sector ETFs as listed above.

If they move up in value by 5%, which they have, a I allocate another 5% increment, provided we are not yet fully invested.

I like to go with strength and upward momentum when making my investment decisions.

I also include RE as a standard portion of my portfolio, although throughout 06 it was approx. 12% of total assets.

In another discussion I mentioned that VDC (Vanguard Consumer Staples ETF) was one of only two positions I retained during the 06 summer correction. My RE fund was the other one, but for very different reasons. I held the TIAA Real Estate fund in a past employers account that I have retained. It showed astounding resiliency last summer and, in fact, never moved downward during the period. But, there was a tradeoff, as it has since underperformed other choices (like VNQ, Vanguard REIT ETF).

So, as a result, I have liquidated the TIAA REIT and will move the funds into, most likely, VNQ. Although with a 12.79% YTD run-up I’m going to have to be paying close attention to a correction in this arena.

G.H.

GH,

Yes, any of the above REITS have performed well. Given their volatility, they did fairly well during the correction of May/June 06. They all came off their highs by anywhere from 10.16% to 11.30% on 5/23/06.