Riding the hopes of a European debt solution pushed the major market ETFs to the upper end of the trading range. While domestic equity ETFs still remain on the bearish side of the trend line, some sector ETFs have crossed to the upside and are offering opportunities for gaining limited exposure.

Yesterday, I took advantage of early weakness to add XLP to clients’ portfolios as well as to some of our ETF Models. There are a couple other possibilities I have my eye on. Another strong push may very well be the one that confirms an upside breakout and brings domestic equities into play again.

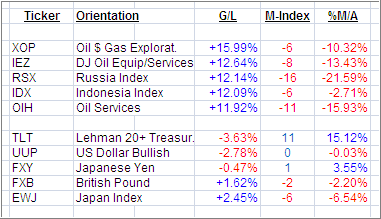

Take a look at the latest numbers: