MarketWatch featured an interesting piece this past week titled “Don’t Get Fooled By Bernanke.” In case you missed it, here are some highlights:

MarketWatch featured an interesting piece this past week titled “Don’t Get Fooled By Bernanke.” In case you missed it, here are some highlights:

The Dow Jones Industrial Average jumped nearly 200 points (last) Friday after the Federal Reserve chairman’s pep talk on the economy. Worldwide markets followed suit. And long-term interest rates rose on his sunnier outlook.

Yes, the Fed chairman seemed to rule out a double dip. And yes, he said he stands ready to pump more money into the system if it should falter.

But so what?

On forecasts, the Fed chairman is about as useful as a New England weatherman.

As for the talk of more quantitative easing: A close reading of Bernanke’s word’s make you wonder if he even understands the crisis at all.

Let’s look at the forecasts first. “I expect the economy to continue to expand in the second half of this year, albeit at a relatively modest pace,” Bernanke said at Jackson Hole.

Good news? Some people clearly thought so.

But this is the man who four years ago predicted a “a leveling out or a modest softening” in home prices. (He also said households were in “reasonably good” financial shape, because their booming house prices were offsetting their rising debts).

Just over three years ago he said the subprime crisis “seems likely to be contained”, adding that he saw “some tentative signs of stabilization” in house prices.

As late as April, 2008, with the great implosion just months away, he forecast “a return to growth in the second half of this year and next year.” You remember that return to growth we had in the fall of 2008, don’t you?

Last Friday he admitted the Fed had been as surprised as everyone else by the sharp downturn in the U.S. trade balance in the second quarter. So what’s new?

When the time comes to write Ben Bernanke’s biography, I already have a great title. How about “Behind The Curve”?

I don’t want to be unfair. He issued caveats along the way. But so he did again last week. Nothing’s changed. And maybe Ben Bernanke’s economic forecasts aren’t any worse than anyone else’s. But that’s hardly the point, is it? And even if they’re no worse, are they any better?

Given his record, Ben Bernanke is not exactly a man whose forecasts mean anything.

Through my lens, the real estate/mortgage/credit bust was the result of over 30 years of reckless debt binging for material satisfaction, which finally blew up. There has to be a normal unwinding process, which will take its time and can’t be stopped by silly stimulus programs or other artificial means.

However, kicking the can down the road will merely postpone the outcome and not solve it. I have referenced the similarity to Japan before. Watching zombie banks held up by “adjusted” accounting rules and ever increasing debt levels, that may take generations to pay, are band aids and not permanent solutions to today’s problems.

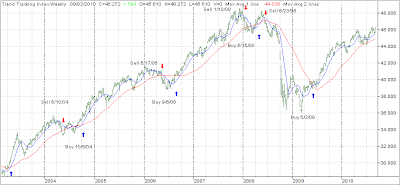

As trend trackers, we don’t really care if Bernanke’s ideas or any other forecaster’s projections are correct or not. All known facts for any given day are represented in the closing prices of equities, bonds or any other asset class. These then form trends we can follow without getting emotional.

Ideally, that’s the point you want to reach. Be independent in your investment decisions from all the hoopla and try not to listen to anyone’s opinion as to what might or might not happen. Control your emotions, and you will be a better investor in the long term.