- Moving the market

As we approach the conclusion of the Jackson Hole symposium, the major indexes have been experiencing volatility ahead of Fed Chair Powell’s anticipated commentary. Historically, Powell’s speeches at Jackson Hole have often boosted equities, but when they haven’t, sharp declines have followed.

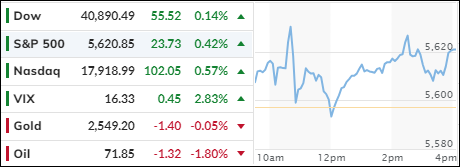

Currently, the S&P 500 is within 1.25% of its all-time intraday high set in July. If Powell’s speech aligns with traders’ expectations regarding interest rate policy, we might see the index reaching a new record high.

The odds of a decrease in borrowing costs stand at 100%, but the extent of the cut remains uncertain, leading to much speculation. Traders are already pricing in a rate cut, reflecting their confidence in this outcome.

On the economic front, home sales ended a four-month losing streak in July, rising by 1.3% month-over-month. However, despite this modest improvement, sales remain sluggish.

This negative sentiment is also evident in the ECO US Surprise Index, which has dropped to levels last seen in 2015. The rise in bond yields, coupled with falling rate-cut expectations, highlights the market’s confusion over whether we will experience a hard or soft landing.

Equities took a hit, with even the MAG7 basket retreating. However, the dollar rebounded due to higher yields, pulling gold back below the $2,500 level. Crude oil prices saw a slight recovery, while Bitcoin faded but found support at the $60k level.

ZH reminds us that the past few years have seen a “sell the news” event following the Jackson Hole symposium.

Will this time be different?

Read More