- Moving the market

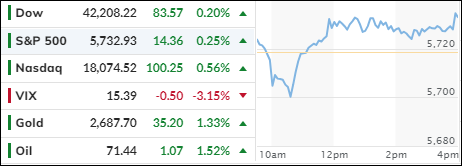

The major indexes began the session without clear direction, hovering around their unchanged lines. However, they seem poised for a positive finish to this volatile month of September.

Stock performance was mixed. Hewlett Packard rose over 4% following an upgrade, while Germany’s SAP fell more than 2%, and General Motors dropped nearly 6% after a downgrade.

New Home Sales declined in August despite lower mortgage rates and increased mortgage applications. This data predates the Fed’s new easing cycle, raising the question: will we see a reversal soon?

Today, the tech sector was the standout performer, driven by gains in Nvidia and Meta. In contrast, Small Caps were the biggest losers, and utilities led among the sectors. The market lacked a clear driver, likely due to anticipation of Powell’s speech tomorrow and the latest GDP data release.

Bond yields increased, the MAG7 basket initially surged but faded by the close, and the most shorted stocks remained within their recent trading range. The dollar rebounded from yesterday’s weakness, recovering all losses.

Gold hit another intraday high but couldn’t maintain its advance into the close, diverging from the dollar. The stronger dollar also pulled down crude oil and caused Bitcoin to slump after Tuesday’s surge.

As Zero Hedge pointed out, US sovereign risk now exceeds recent months’ levels. Does this indicate that something has broken or is about to?

Read More