- Moving the market

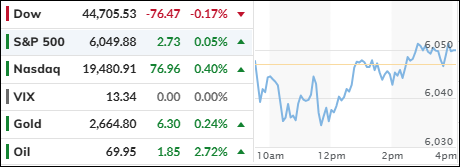

After yesterday’s strong gains, the markets took a breather today, with major indexes closing moderately lower. Small Caps suffered the most significant losses.

Last night, the much-anticipated event occurred when Bitcoin pierced the $100k level for the first time. Within minutes, it surged to $104k before leveling off slightly below that mark. During today’s session, Bitcoin slipped and settled around $98k.

Historically, such bullishness in Bitcoin has positively impacted the Nasdaq, but so far, the tech index has not reacted.

The latest first-time filings for jobless benefits rose by 9,000 to 224,000, higher than the estimated 215,000. On a positive note, continuous claims edged lower by 25,000 to 1.871 million.

Despite flat bond yields and a declining dollar, gold struggled to find footing and dropped by 0.82%. However, the Mega-Cap basket defied the overall market weakness and inched higher.

It was a quiet, directionless session ahead of tomorrow’s jobs report, an event that has the potential to catch traders off guard.

Read More