- Moving the market

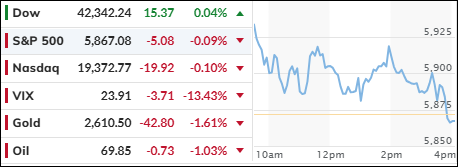

Despite an early dip, the markets quickly rebounded, with major indexes closing in the green and keeping hopes of a Santa Claus rally alive.

This solid recovery followed last week’s turmoil, during which the Dow endured a 10-day losing streak and plummeted over 1,100 points on Wednesday. This drop was triggered by the Federal Reserve’s announcement that fewer rate cuts would be planned for 2025 than previously anticipated.

Early in the day, weak economic data dampened sentiment, as the Consumer Confidence Index for December fell to 104.7, its lowest level since September and below the expected 113.

However, even worsening Economic Surprise data and softening survey data couldn’t hold back the bulls. The rebound continued, despite the low liquidity typical of the pre-Christmas period.

The tech sector led the day’s gains, with heavyweights Tesla, Meta, and Nvidia each adding at least 2%. Bond yields rose, the dollar recovered from Friday’s losses, and gold moved in the opposite direction. Bitcoin remained steady over the weekend but declined in today’s session.

Tomorrow will be a shortened session on Wall Street, and I won’t be providing a market commentary. However, I will return on Thursday to close out the week with the usual reports.

Merry Christmas!

Read More