- Moving the Markets

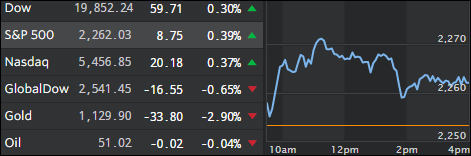

It was a reluctant rally with investors being hesitant considering that the major indexes were still hovering near all-time highs; bond markets finally managed to stage a modest recovery after the drubbing of the past few weeks.

Not helping matters were reports from Germany that a truck ran into a crowded Christmas market in Berlin killing 9 and injuring an estimated 50 people. In Turkey, the Russian Ambassador in charge of Syrian piece-talks was attacked and killed as he was getting ready to give a speech.

And, of course, today was voting day for the Electoral College the official result of which will not be known until early next year.

Hong Kong stocks corrected, Italian banks crashed, the NYSE suspended trading for a while, after which equities rallied, and we’re still waiting for the moment in time that the Dow hits the 20,000 level or has two down days in a row, which it has not seen for 7 weeks.

It was a tumultuous day with no clear direction.