ETF Tracker StatSheet

Market Commentary

Year End Resistance

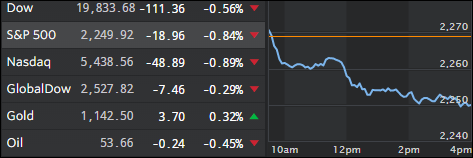

[Chart courtesy of MarketWatch.com]- Moving the Markets

For sure, I thought there would have been a last minute attempt at reaching the much talked about 20k Dow level during this last trading week of 2016, but it did not happen.

Actually, the post election momentum reversed with the S&P 500 declining for a third consecutive session but managed to gain 9.5% for the year thanks to Fed intervention back in February and mid-year during the Brexit drop.

Of course, the Trump pump in the face of rising interest rates helped the indexes big time, but it remains to be seen if there is any staying power once Trump takes over on January 20th when underlying economic realities are certain to surface along with the fact that his ambitious plans may run into opposition even within his own party.

Despite the market euphoria of the past 6 weeks, our main directional indicator, the Domestic TTI, see section 3 below for the latest update, did not play along by advancing only modestly indicating a lack of conviction due to a rising interest rate environment, which will eventually be negative for equities. Be sure to stay tuned for the latest updates as the New Year gets underway.