- Moving the Markets

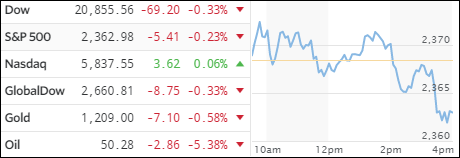

It was another mixed day in the markets as encouraging news via a stronger-than-expected ADP employment report was offset by a collapse in oil prices, which got hammered at the rate of -5.38%, their biggest drop in over a year, caused by a bearish inventory report.

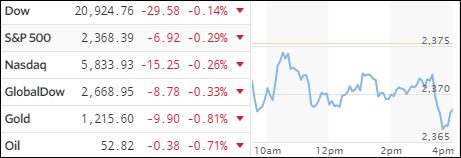

The ADP report showed that private companies added the most jobs in three years in February (280k), which is interpreted as a sign of stronger economic growth. The U.S. government will issue its own broader jobs report on Friday, which will be the last reading before the Fed’s verdict on interest rates due out next week.

The 10-year yield jumped to 2.56% from 2.52% and is now in danger of crossing the 2.6% threshold level, which is widely associated with having a negative effect on equities. Of course, 2.6% is not a hard number, but a yield in the range of 2.6% to 3% is considered a warning sign; sort of the canary in the coalmine.

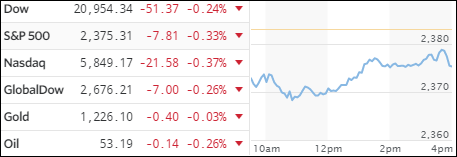

Ever since Trump’s speech to congress a week ago, the markets have been slipping and sliding, although the magnitude of the retreat has been small and only 0.9% as measured by the Dow. However, the sell-off has been broad based with macro data, emerging markets, copper, high-yield credit, REITs and crude oil all breaking down as “derisking” seems to have been the mantra.

For the time being, however, the major trend in the domestic investment arena, with the exception of a few sectors, remains bullish as my TTI indicator in section 3 below shows.