ETF Tracker StatSheet

https://theetfbully.com/2017/05/weekly-statsheet-etf-tracker-newsletter-updated-05182017/

BULLARD PUMP DRIVES MARKETS

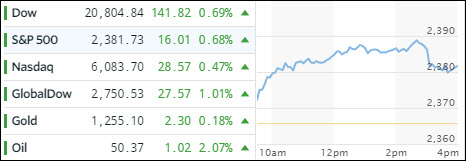

[Chart courtesy of MarketWatch.com]- Moving the Markets

When all else fails, and the markets are in danger of heading south in a big way, it’s nice to know that we can always count on one of the Fed mouthpieces to create an enticing news headline, designed to be picked up by computer algos to push the markets in the desired direction.

Such was the case today, when James Bullard took to the airwaves in a prepared speech saying that “all the talk of an “overheating” economy was just that saying that “financial market readings since the March decision have moved in the opposite direction” of what would normally occur after a rate hike, adding: “this may suggest that the FOMC’s contemplated policy rate path is overly aggressive relative to actual incoming data on U.S. macroeconomic performance.”

Translation: We are not sure if further rate hikes are really warranted as he added that inflation and inflation expectations “have surprised to the downside” and noted that “financial market readings since the March decision have been opposite of expectations.”

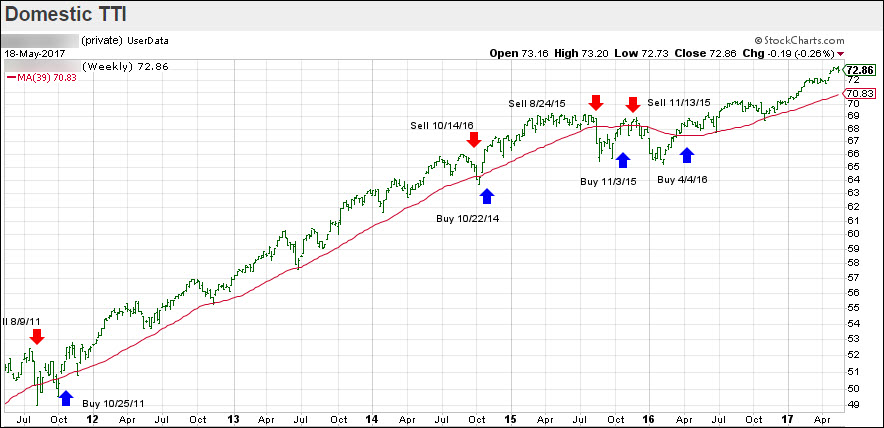

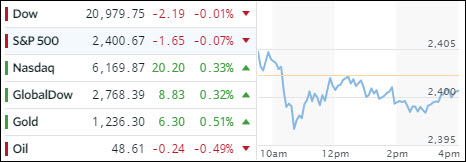

That’s exactly what computer algos wanted to ‘hear’ and off to the races we went with the three major averages closing in the green for the day but in red for the week. US Macro data disappointed for the 9th straight week and have now dropped below the election lows as the chart shows: