- Moving the Markets

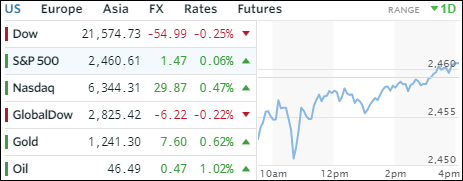

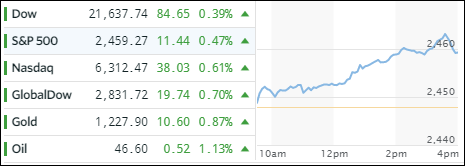

Despite IBM being a drag on the Dow (about -47 points), and the Transportation index (IYT) stumbling for the third day in a row, its biggest drop in 2 months, all three major indexes were able to march into record territory on low volume and no earthshaking news.

Helping the bullish cause were better-than-expected earnings from Morgan Stanley, which helped to create some optimism in the face of a slowing economy and, at least for the day, lent support to the current lofty index levels.

Across asset classes, SmallCaps took top billing with SCHA gaining a solid +1.02%, which was closely followed by Semiconductors (SMH) and MidCaps (SCHM) adding +0.99% and +0.94% respectively. Financials struggled but ended up in the green and Retail continued its recent bounce. Interest rates remained unchanged, while the US dollar (UUP) did its best dead-cat-bounce imitation by gaining +0.24%.