- Moving the Markets

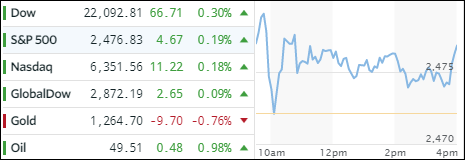

Yesterday’s slippage continued early this morning, but dip buyers stepped in encouraged by a NT Times story alleging that Trump’s ‘Fire and Fury’ words were his own and not US policy. During the last hour, the whipping boy of the year, AKA the VIX, was spanked again and while helping the indexes recover, they fell short of the intended goal, namely to cross back above the unchanged line.

With geopolitical uncertainty in full swing, it was no surprise to see gold rally solidly by adding +1.53%. In regards to equity ETFs, we saw mainly red numbers with SmallCaps (SCHA) surrendering -0.75%, closely followed by MidCaps (SCHM) with -0.53%. Even the Emerging Markets (SCHE) were unable to mount a rally and gave back -0.82%. Eking out a tiny gain were Dividend ETFs (SCHD) with +0.04%; Transportations (IYT) closed unchanged.

While FANG stocks continued their journey south, Apple scored a new record high and gained +0.61%. The VIX headed north again and broke above the 12 level, and above its 200-day M/A, which is quite a change from its recent all-time low just below 9. If this trend is sustained, equities will eventually be negatively affected. Bonds were the beneficiary of this uncertainty as yields dropped and the 30-year bond rallied to add +0.55%. The US dollar (UUP) was fairly docile, traded sideways and closed down -0.08%.