ETF Tracker StatSheet

https://theetfbully.com/2017/09/weekly-statsheet-etf-tracker-newsletter-updated-09142017/

MISSION ACCOMPLISHED: S&P 500 CONQUERS ITS 2,500 LEVEL

[Chart courtesy of MarketWatch.com]- Moving the Markets

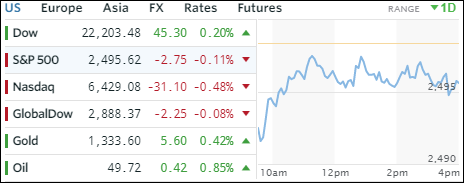

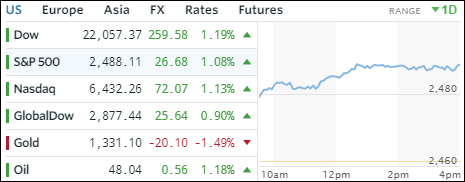

As we have become accustomed to, news reports, that should affect markets negatively, were ignored as the major indexes continued relentlessly higher with the S&P managing, at the very last minute, to close above its 2,500 marker for the first time.

The latest N. Korean missile test was shoved aside as were economic reports that were anything but comforting. First, there were retail sales, which tumbled in August -0.2% MoM with, surprisingly, online sales slumping. At the same time, July’s gains were revised and cut in half. The August industrial production numbers crashed the most since May 2009 as auto sales collapsed. Completing the trifecta of bad reports was a slipping consumer confidence index.

ZH summed up this week best:

- Hurricane Irma crushes Florida

- North Korea test fires ICBMs across Japan (again)

- Economic data misses across the globe (China and US most notably)

- Terrorism in UK and France

And the result – drum roll please – new record highs for the Dow, the S&P, and the Nasdaq… with the Dow’s best week of the year! Go figure…

In ETF space, Semiconductors (SMH) took top billing today by gaining +1.32% with Emerging Markets (SCHE) occupying a distant 2nd place with +0.70%. On the downside, we saw only one red number and that was Transportations (IYT), which lost -2.00%.

Interest rates ended the day unchanged, gold slipped again, and the US dollar (UUP) lost -0.33% on the day but managed to eke out a gain for the week. Nevertheless, its YTD downtrend remains intact, and the loss is now over 11%.