ETF Tracker StatSheet

https://theetfbully.com/2017/11/weekly-statsheet-etf-tracker-newsletter-updated-11222017/

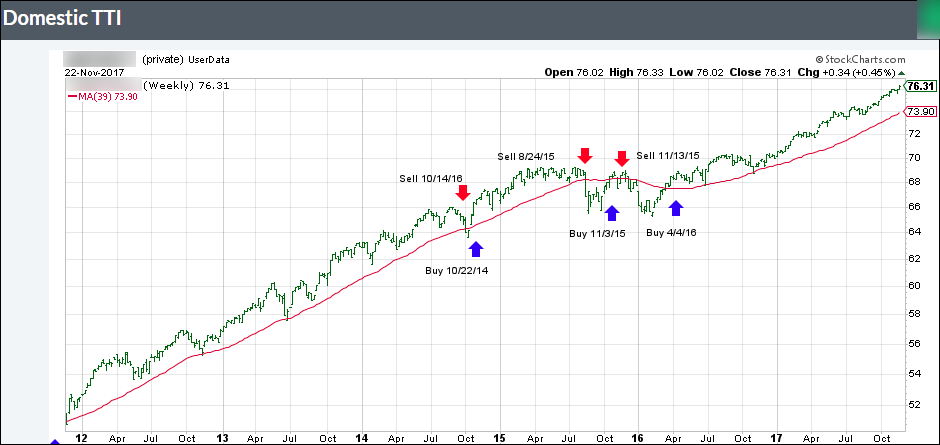

CLOSING AT NEW ALL-TIME HIGHS

[Chart courtesy of MarketWatch.com]- Moving the markets

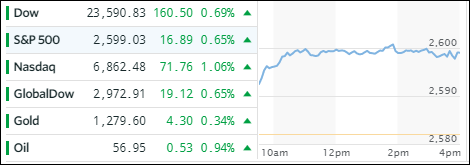

Despite this being a Holiday shortened week, 2 of the 3 major indexes (S&P 500 and Nasdaq) managed to close at new records with the S&P booking a gain of +0.9% over the past 4 sessions. Retailers were obviously in focus, but the retail ETF (XRT) closed down -0.43%, however, we will have to wait and see if Black Friday really turns into the game changer the industry has been hoping for.

Across the ETF space, we saw predominantly gains but also some losses. Closing solidly in the green were Semiconductors (SMH +0.83%), followed by International Equities (SCHF +0.73%) and International SmallCaps (SCHC +0.49%). On the downside, we saw Emerging Markets (SCHE -0.28%) and Transportations (IYT -0.05%).

Interest rates were mixed but the 10-year bond yield rose 2 basis points to end the week at 2.34%. Oil rallied, gold pulled back and the US Dollar (UUP) took another dive and gapped down -0.45% to lows last seen in September.