- Moving the markets

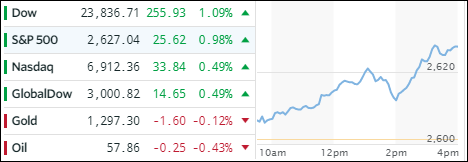

And the beat goes on. Optimism about the tax plan prospects went into hyper drive with John McCain appearing to be the catalyst by casting his “YES” vote convincing traders that a tax reform may actually happen. That motivated the bullish crowd, and the major indexes jumped. Even though we came off the highs mid-day, it was enough for the Dow to register its longest streak of monthly gains in 22 years.

In ETF space, we saw gains of varying degrees across the board. Following through on yesterday’s top performance of +3.4% were Transportations (IYT), which added another +2.01%. That was followed by Aerospace & Defense (ITA) and the Dividend ETF (SCHD) with +1.25% and +0.94% respectively. Not being aligned with today’s bullish theme were Emerging Markets (SCHE) with a loss of -0.76%.

Interest rates rose sharply with the 10-year bond yield jumping 5 basis points to 2.42%. Gold got spanked again and lost -0.74%. Every time the yellow metal is in danger of breaking through its $1,300 marker, it gets slammed down thanks to the manipulated derivatives markets on the COMEX. The US dollar (UUP) managed to recover some of its early losses but still closed down -0.25%.