- Moving the markets

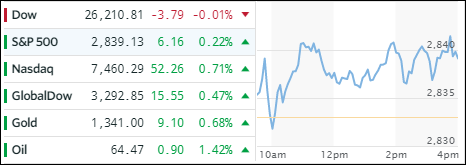

Two of the three major indexes stormed into record territory again after upbeat earnings boosted investor sentiment, and the bulls shifted into overdrive ignoring the Dow’s weakness. Helping matters was Netflix’s rally, as it topped the $100 million market cap. Also throwing in an assist was the ending of the government shutdown, although Congress only passed a 3-week funding measure, AKA: we solved nothing but merely kicked the can down the road.

Be that as it may, green numbers prevailed and the ETF space benefited as well. Closing to the upside were Semiconductors (SMH) with +0.65% with MidCaps (SCHM +0.39%) and Emerging Markets (SCHE +0.39%) following closely behind. Giving back some of their recent gains were Aerospace & Defense (ITA -0.33%) and the Dividend ETF (SCHD -0.24%).

Interest rates took a breather today with the 10-year bond yield declining 3 basis points to 2.63%. Gold and Crude oil advanced but the US Dollar UUUP), which has been in bearish territory since last May, took another -0.25% dive to close at its lowest since December 2014.