- Moving the markets

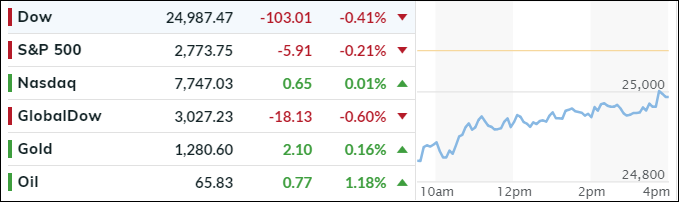

The market’s divergence continues with the Dow struggling and notching its 7th straight losing day, which is its longest streak since early 2017.

In contrast, the Nasdaq continued to blast higher, along with SmallCaps, seemingly not yet negatively affected by the worsening trade battle between the U.S. and China but instead receiving a strong assist by the continued short squeeze.

As ZH pointed out, not only have 13 of the last 15 days seen “most shorted” stocks rise, it’s also been the biggest short squeeze in the history of the data. Just look at the parabolic rise in the S&P stocks. Makes me wonder if this could be a blow-off top?

Interest rates rose modestly with the 10-year bond yield adding 4 basis points to end at 2.93%, which is still a respectful distance from the 3% level that has been troublesome in the past.

Today’s market activity had the feel of a relief rally, despite Trump increasing the rhetoric with the Chinese last night when accusing them of “waging a systematic campaign of economic aggression.” Not exactly soothing words for the Wall Street crowd but sufficient to at least temporarily halt the downward swing in the broader markets.

Our Trend Tracking Indexes (TTIs) recovered with the International one remaining in striking distance of breaking through its trend line to the downside and signaling a “Sell.” See section 3 for more details.

It appears, the markets have not yet priced in any potential global issues affecting earnings negatively, should these trade talks stay in that fragile state as they’ve been. Things could explode in a hurry, which is why we need to be prepared to deal with a sudden turnaround in sentiment or possibly stay on board a while longer until more consequences become obvious.