ETF Tracker StatSheet

A WILD WEEK, BUT S&P 500 ENDS UNCHANGED

[Chart courtesy of MarketWatch.com]It should come as no surprise that, based on the drubbing of the foreign currency markets, as I detailed yesterday, emerging market equities could not be far behind. That materialized today, as our emerging market ETF holding pierced its trailing sell stop and was liquidated in accordance with our sell stop discipline.

Domestically, the major indexes started in the red, as the U.S.-China trade dialog heated up with tensions escalating, but calmer heads prevailed on Wall Street, and a slow rebound ensued, which ended just short of the unchanged line.

It’s amazing that, despite the chaos not just in FX (Foreign Exchange) but also the debt and commodity arenas, the major indexes held up well with the S&P 500 closing just about even for the week, helped in part by the VIX getting crushed again.

The large banks lost, while the US Dollar had its highest weekly close since July 2017, which was exactly opposite of the Euro, which had its lowest weekly close since July 2017. Not looking too good either was the Commodity Index which, after a stellar YTD performance, was crushed this week. To me, that is just a temporary pullback since inflationary forces will continue to grow and affect the commodity sector positively.

Currently, I see two prevailing opinions regarding market direction. One is held by the smart money, represented in part by some well-known fund managers, who seem to have left equities, as this chart shows. On the other side are those, who are seeing a strong return of inflation and with it racing equity markets ending with a blow-off top sometime later this year.

Of course, along the way, there are a host of Black Swans lurking and waiting for the right moment to make an appearance. Since no one knows how this will end up playing out, we’ll continue to follow the major trends via our TTIs and execute our trailing sell stops when it becomes necessary.

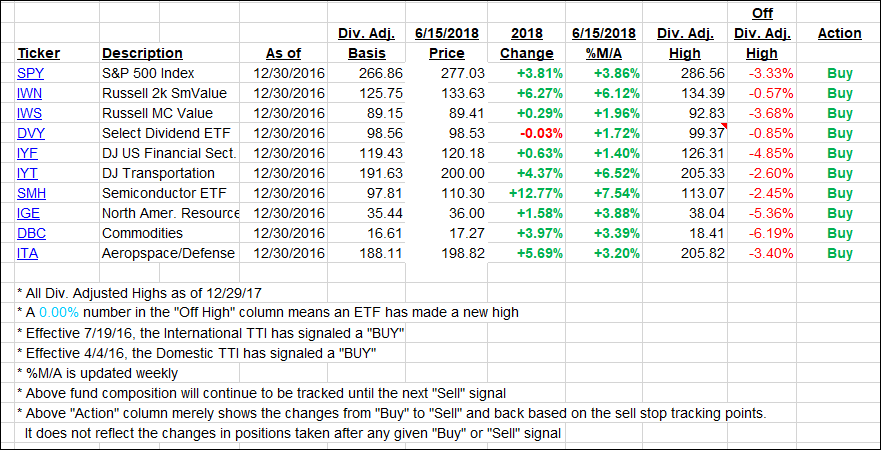

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the International one taking a steeper drop than the Domestic one.

Here’s how we closed 06/15/2018:

Domestic TTI: +2.83% above its M/A (last close +3.01%)—Buy signal effective 4/4/2016

International TTI: +1.26% below its M/A (last close +1.81%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli