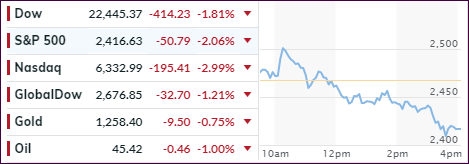

- Moving the markets

One market technician called yesterday’s massive rebound a sucker’s rally and for most of today, with the major indexes trading way down, his view seemed to be correct except, it was not over yet.

A powerful reversal during the last hour appeared to be a continuation of the quarter ending re-balancing by pensions plans (and a giant short squeeze) I mentioned yesterday. It pulled equities out of the doldrums, which ended in the green for the second day in a row, as the Dow staged a nearly 900-point turnaround.

The early plunge did not come as a surprise after economic confidence figures got smashed and the US jobs outlook crashed the most on record. December’s number dropped from 136.4 to 128.1 vs. expectations of 133.7 and slipped to its lowest level since July.

I expect this type of see-saw action to continue throughout the final trading days of this year, but I am pondering the question “what bullish forces might be left after the pension funds are done with their adjustments?”

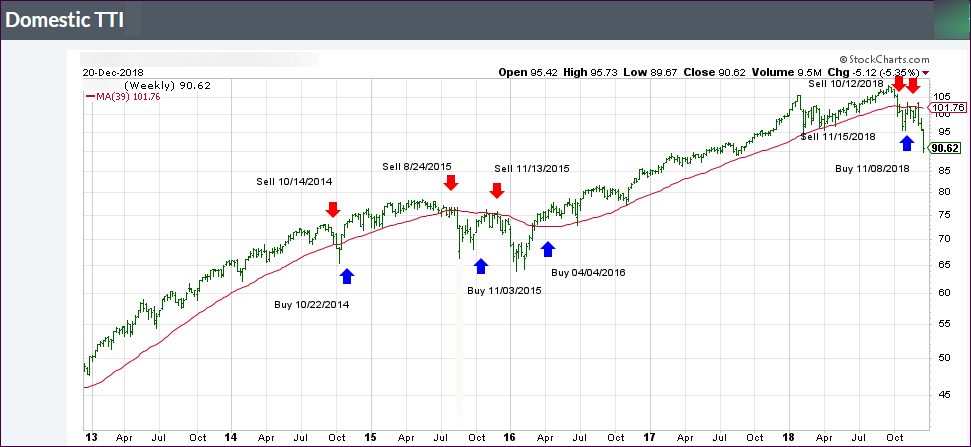

We’ll have to wait and see but, right now, no matter how much lipstick you put on December, it is still a pig as this chart (courtesy of ZH) shows.