- Moving the markets

The much-discussed mid-level US-China trade talks came to an end today with the warring factions jawboning about “being serious” coming to an agreement and that “progress has been made.” Both parties announced to release a “message” on Thursday.

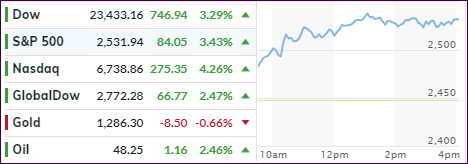

The market impact was minor but kept the major indexes in positive territory early on. All eyes were on the release of the Fed minutes where members of the FOMC showed some willingness to delay further rate hikes due to the volatility in financial markets while, at the same time, concern about global growth, or lack thereof, was foremost on their minds.

In the end, it seemed that future monetary policy would be more “cautious,” which goes along with Powell’s recent U-turn that the Fed would change policy swiftly if economic conditions warrant such a move. While these words seemed to calm the markets, the see-sawing continued but kept the major indexes in the green.

ZH added that during the last four days we have witnessed the biggest short-squeeze since March 2009, while China pumped and dumped and Europe extended its gains led by Italy. The US Dollar tumbled the most since last November to its lowest since September 2018.

Equities are now up 8 of the last 10 days, which translates into the best start to a year since 2010. As I keep mentioning, the most impressive rebounds and jaw-dropping dips happen while we are in a bear market.

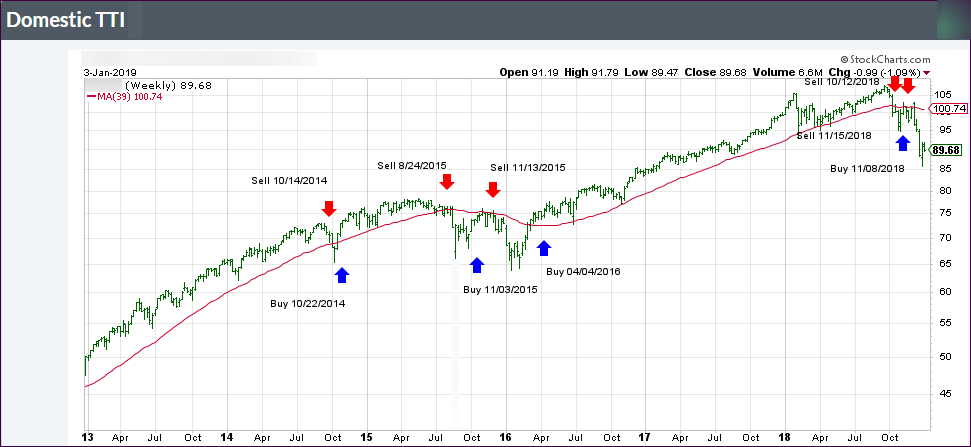

The question remains, will there be enough staying power to lift our Domestic TTI back into bullish territory? Very possible. If the Fed continues to play ball the way the markets like it, and Trump gets an acceptable trade deal with China, we may very well see a new domestic Buy signal develop soon.