- Moving the markets

We started the day in the red after China set the sour mood by reporting another month of declining industrial profits. Things got worse when Caterpillar (CAT), an economic bellwether conglomerate, missed earnings by a huge margin, its worst performance in 10 years, causing its stock price to decline by -9.13%; a dead CAT bounce did not materialize.

Then it was Nvidia’s turn to support the bearish momentum after slashing guidance and fourth quarter revenue. Despite blaming China and worsening global economic conditions, the punishment was instant with the stock losing some -14%, which affected the Nasdaq more than the other 2 major indexes.

So, it’s no surprise that nervousness among traders prevailed. Not helping matters are an upcoming 2-day Fed meeting, a barrage of delayed economic data (due to the shutdown) and a huge week for earnings with 126 S&P 500 companies set to release their quarterly report cards. Keep in mind that earnings expectations are at 6-month lows…

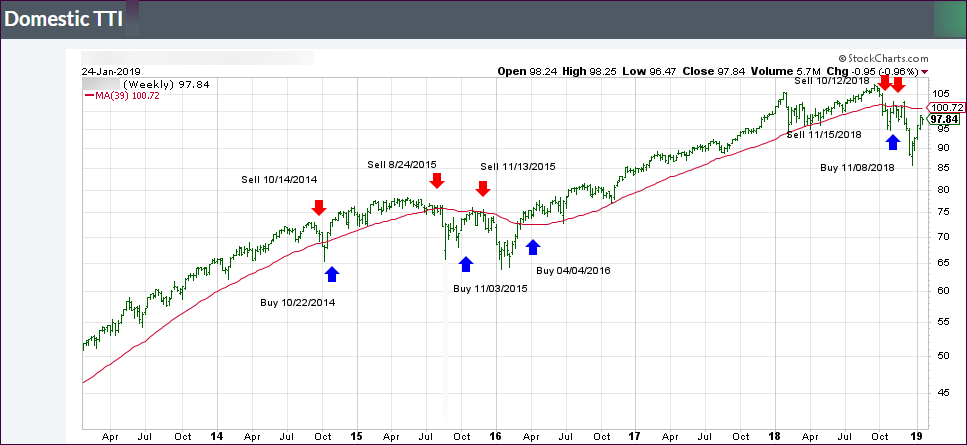

All 3 events have the potential power to wreak havoc with the markets, and it is totally uncertain whether the bulls or the bears will come out ahead at Friday’s close. That makes it a more comfortable week for us trend followers by being on the sidelines, as our Trend Tracking Indexes (TTIs) still remain in bear market territory.