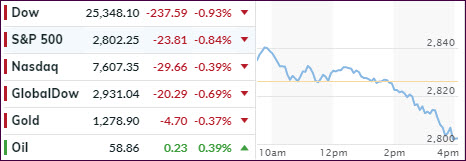

- Moving the markets

For a change, the markets opened slightly to the upside, before a slow and steady decline pulled the major indexes into the red, however, a last hour buying effort saved the day and we ended up modestly in the green.

While the trade war battle continued in full swing, Wall Street traders apparently decided to take a break from the constant stream of news, including the accusation by China that the U.S. uses “naked economic terrorism,” “economic bullying” and the assertion that they will “fight until the end.”

Regarding economic news, we learned that after weakness in new- and existing-home sales in April, the pending ones were expected to do better, but no dice. Instead pending sales slipped -1.5% MoM, its worst decline since the financial crisis in 2008.

The bond market continues to paint an ugly picture with the 10-year yield plunging again after a late rebound yesterday. This prompted ZH to post this chart with the at this point unanswerable question “will the relationship between the S&P 500 and the 10-year yield revert like in 2016 (higher rates) or 2007 (lower equity prices)?”

With a little bit of patience, we will find out.

Read More