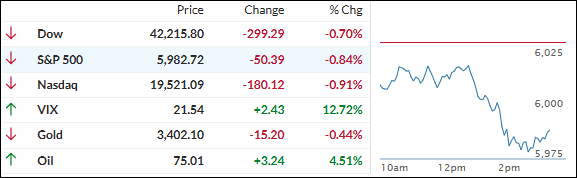

- Moving the market

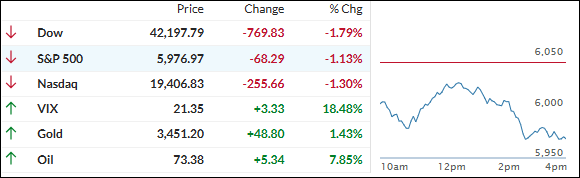

The markets opened in the red today, weighed down by fresh tensions in the Middle East.

Hopes for a ceasefire between Israel and Iran were dashed, as the conflict showed no signs of cooling off—despite earlier reports suggesting otherwise.

Oil prices surged nearly 5%, reversing Monday’s dip that had been sparked by a Wall Street Journal report hinting at Iran’s willingness to negotiate. With the saber-rattling back in full swing, energy markets are on edge again.

Adding to the pressure, retail sales came in weaker than expected. Consumer spending dropped 0.9% in May, missing forecasts of a 0.6% decline.

That’s not a great sign for the economy, especially when paired with other downbeat data: industrial production slipped, and homebuilder confidence hit a 13-year low.

The gap between “hard” and “soft” data is narrowing, and traders took notice—especially in retail, where some of the market’s favorite names took a hit. Meanwhile, the most shorted stocks gave back yesterday’s gains in a hurry.

In other markets, bond yields fell across the board, the dollar had its biggest jump in six weeks, gold stayed flat, and silver popped over 2%. Bitcoin spiked at the open but pulled back, finding support around the $104K mark.

Now, all eyes are on the Fed. Will they surprise Wall Street with a rate cut tomorrow?

Read More