- Moving the markets

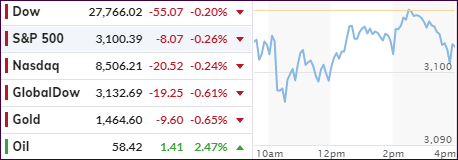

The markets took another jump higher powered by some mega mergers and the good old stand-by, namely the trade talks. All last week’s concerns vanished over the weekend on China’s decision to issue guidelines and raise penalties for intellectual property theft.

This was immediately interpreted as a step in the right direction boosting the chances of a trade deal between the U.S. and China. Never mind that Reuters reported that a “phase 2” of the deal may not happen any time soon, if ever.

This was offset by a tweet by the Chinese mouthpiece, the Global Times, which said that the warring parties might be “very close” to reaching a “phase 1 deal,” according to the infamous and unknown experts close to the Chinese government.

This got the rally started, and the major indexes never looked back with all three of them setting new intraday highs and/or surpassing previous records. As we’ve seen many time before, giving a huge assist was the biggest short squeeze we’ve seen since October which sent SmallCaps sharply higher.

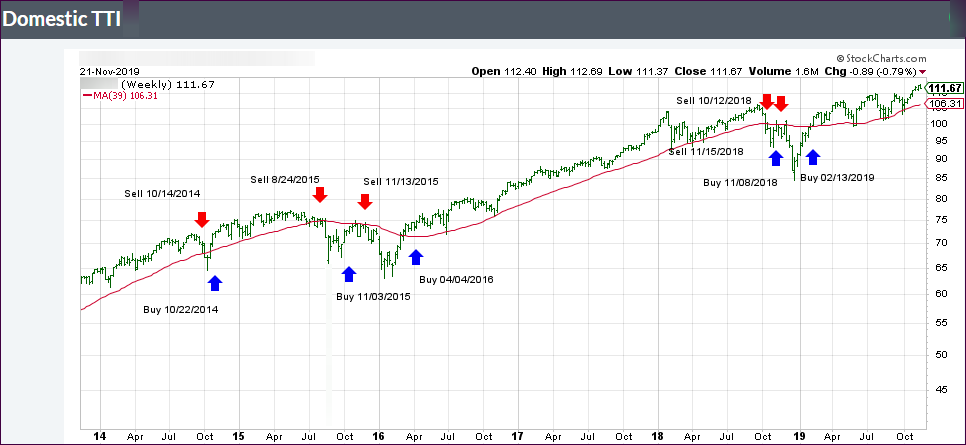

Surprisingly, and may be due to continued issues in the overnight lending market (repos), global liquidity started to reverse, just like it did in April. That brings up the question as to whether equities will follow. After all, as I have posted numerous times, the big driver of stocks is liquidity. If that continues in the direction this chart from Bloomberg indicates, we could see equity weakness ahead.

Read More