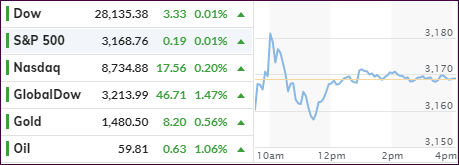

- Moving the markets

The markets continued their bullish ways into a new week with the supporting actor being the upbeat mood caused by last week’s preliminary trade deal between the US and China.

Despite of all the hysteria, many questions remain over the details of the much-hyped “phase one” accord. The Chinese were pleased, because it included a partial rollback of some tariffs and the ditching of further duties on imports.

If we can believe US trade representative Lighthizer, then the phase one deal is “totally done” and goes beyond agriculture and addresses intellectual property issues, financial services and their respective enforcement provisions.

Still, come contentious issues will need to be resolved, but that would be done in the “phase two” talks, which still must be scheduled. The “phase one” deal is supposed to be signed in January.

Bond yields continued their roller coaster ride by jumping 5.3 basis points to end the day at 1.88%, but equities were in a world of their own but, while coming off their early highs, still managed to score solid gains.

Supporting the bullish trend was another giant short squeeze, which crushed any remaining bearish sentiment that may have been waiting in the wings. Short squeezes have been a major support tool designed to keep the upbeat mood alive.

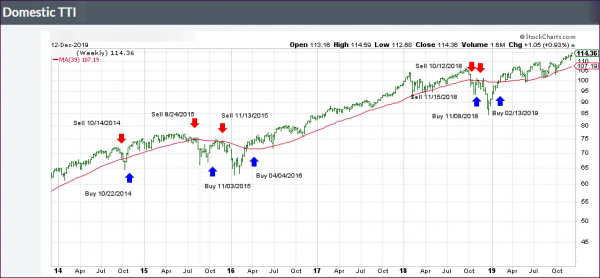

But in the end, the powerbroker to drive this market has been central bank liquidity, as this chart demonstrates. Without it, we would be celebrating the upcoming holiday with considerably lower index levels.

Read More