- Moving the markets

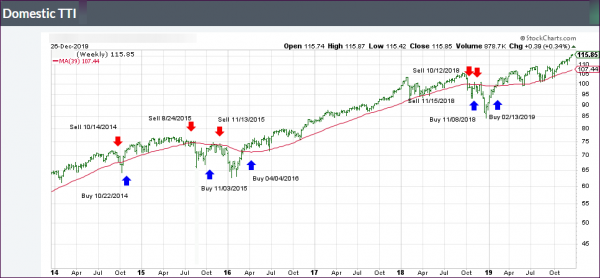

Despite the major indexes hovering below their respective unchanged lines for most of the session, a last hour boost pushed them back into the green, thereby closing the last trading day of the year on a positive note.

Low volume and profit taking by traders had equities in the red, until a slow and steady ascent emerged, which was followed by sharp push higher into the close. Positive news on the trade front assured that the early pullback remained moderate. In the end, it ended up being a springboard for higher prices, as we’ve seen many times in the past.

White House advisor Navarro said the China deal was “in the bank,” while Trump confirmed it via a tweet:

I will be signing our very large and comprehensive Phase One Trade Deal with China on January 15. The ceremony will take place at the White House. High level representatives of China will be present. At a later date, I will be going to Beijing where talks will begin on Phase Two!

With 2019 in the bag, let’s remember that not the underlying fundamentals nor a great economy were the driver of stocks and bonds this year. On the contrary, it was Central Bank intervention providing an unprecedented surge in liquidity, a huge portion of which was dumped into the markets. This chart, thanks to Bloomberg, makes that abundantly clear.

Given current Central Bank policy, there is a good chance that this theme will continue in 2020, unless a black swan event upsets the bullish market trend, in which case our exit strategy will be of immense value.

Happy New Year!

Ulli…

Read More