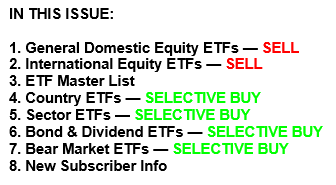

ETF Tracker StatSheet

You can view the latest version here.

ENDING A VOLATILE WEEK ON A POSITIVE NOTE

- Moving the markets

This morning we saw something highly unusual in the markets, namely that the Dow and S&P quickly stormed out of an early hole, with the Nasdaq lagging, something we have not seen in a while. However, when looking at the bigger picture, the tech sector index has been up 8 of the last 9 days and 17 of the last 20 days.

All 3 major indexes closed solidly in the green, but tech simply could not outshine the others today but nevertheless closed on the plus side of its unchanged line.

Despite the US seeing a record number of new Covid-19 infections, and some hospitals in California, Texas and other States reporting rising hospitalizations, traders remained unrattled and kept their focus on potential treatments.

Even the realities of the enormous June budget deficit elicited nothing more than a yawn from Wall Street, with MN Gordon from the EconomicPrism.com adding these comments:

The realities of the madness are too awful for most journalists to offer any real deep analysis. The U.S. budget deficit in June was $863 billion. For perspective, an annual budget deficit of $863 billion is enormously massive and fiscally unsustainable. Yet, now, the U.S. government has racked up $863 billion in debt, in just one month.

For additional perspective, the budget deficit for June 2019 was $8 billion. Hence, the deficit for June 2020 has increased 101x compared to June of last year. This, no doubt, is game overspending; desperate actions by a desperate government to keep this sucker from going down.

For sure, this may not be a problem right now, but it eventually will lead to an erosion of the dollar’s purchasing power, which is why I continue harping on the theme that anyone should own some gold to protect their assets against future dire consequences, namely inflation.

Despite giving back a little today, gold has been hanging on to its $1,800 level with spot gold having reached its highest point since 2011, as Bloomberg’s chart shows.

Our Trend Tracking Indexes (TTIs) made up some lost ground today, but still have not been able to conquer their respective trend lines. One of the reasons is that the TTIs are broad-based indicators, while the rebound of the past has been narrowly defined to only a few stocks, with all of them being part of the Nasdaq, hence the superiority of the tech sector.

Read More