ETF Tracker StatSheet

You can view the latest version here.

DIVING INTO THE WEEKEND

- Moving the markets

An early rally hit the skids with the major indexes diving into the close with only the Dow showing a small gain of +0.39%. The Nasdaq fared the worst by giving back -0.36%, but for the week, equities eked out a small profit.

Helping the Dow snap a 3-day losing streak was a report showing that US Core Retail Sales surged by the most in history, according to ZH. After two straight months of disappointments, September turned out to be the shining star by showing a rise of 1.9% MoM vs. expectations of a meager 0.8%. This translates into a stunning YoY 9.1%, which was the greatest rise ever.

Of course, all that occurred with government handouts in full swing, so we need to see what happens in October, when those “assists” came to an end…

“The economy continues to show pockets of strength, but those pockets need to widen,” said Quincy Krosby, chief market strategist at Prudential Financial. “For those who still have their jobs, the economy has been healing.”

“The question is, if initial unemployment claims continue to rise, will we continue to see retail sales surprising to the upside,” Krosby added.

Regarding the stimulus saga, the signals continue to be mixed with no commitment in sight from either warring party. Although Treasury Secretary Mnuchin indicated that the White House will not derail the stimulus talks with the opposition.

While yesterday’s short squeeze continued early in the session, it lost steam late in the day thereby causing the sell-off during the last hour.

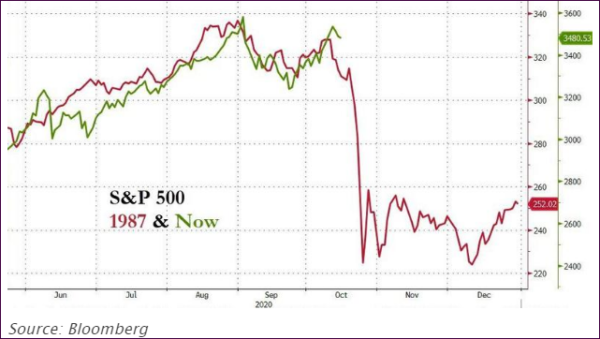

This coming Monday, October 19, marks the 33rd anniversary of the 1987 Black Monday market crash. The analog to the 1987 event is pretty much intact, as you can see in Bloomberg’s chart:

I am not forecasting that we will see a repeat, but you must admit that the similarities leading up to the “event” are striking.

Read More