- Moving the markets

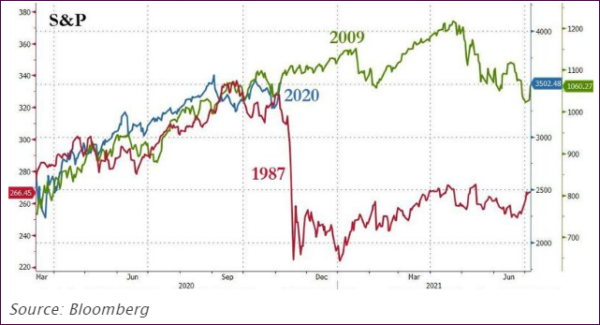

The global rally fizzled out with only one of the major indexes making some headway, namely the Dow, as the S&P 500 slipped slightly into the red, while the Nasdaq sell-off continued, albeit at a lesser pace leaving the index down -1.37% for the day.

Pfizer’s vaccine stock fest hit some reality today with skepticism emerging as to the true efficacy of this vaccine and the ability to deliver it within a reasonable time frame.

The sector rotation persisted out of high-tech and into the Russell 2000 with small-caps and cyclicals anticipated to be the main beneficiaries of an economy recovering from the pandemic. Of course, this is only wishful thinking right now, as the pendulum could quickly swing back the other way.

“The ‘stay at home’ trade, which has led the market higher for most of this year, may be falling out of favor,” said Lindsey Bell, chief investment strategist at Ally Invest. “There’s still a good long-term case for tech, but it may not outpace the rest of the market like it has since March.”

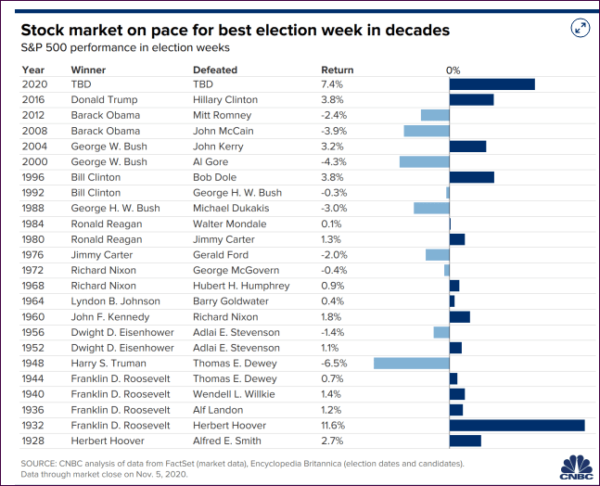

In the meantime, the election uncertainties go on, despite some of the media already having decided who won. The fact is, however, they are not the decisionmaker, so we’ll have to wait and see until this challenge get legally resolved.

Gold managed to bounce back as the US dollar went sideways, while bond yields again spiked with the 10-year closing within striking distance of the 1% level.

In my view, gold remains a “safe haven” in an environment where politically and monetarily things could turn on a dime.

Analyst Peter Schiff had a similar view of gold’s role:

“It’s a safe haven from the monetary and fiscal policy mistakes that were made in reaction to COVID. That’s why gold was going up [during the pandemic]. And it’s because the government is going to continue to make the same monetary policy and fiscal policy mistakes after COVID, that’s why gold is going to keep going up. And in fact, because of all the money they printed before COVID, because of all the extra debt that we accumulated during COVID, that’s why the Fed can’t dial it back. That’s why if the economy recovers from COVID, it can never recover from the addiction to stimulus. That’s why the stimulus has to continue long after the disease it was meant to cure goes away. That means inflation is going to run out of control.”

For sure, until this election is decided, the days and weeks ahead will be anything but boring.

Read More