- Moving the markets

Another day, another roller coaster ride. Sharp early losses were wiped out, as the markets did a U-turn with the major indexes ending moderately in the green. One of our more volatile SmallCap holdings had triggered its trailing sell stop last night and was sold.

Fed head Powell contributed to the early sell-off with these comments:

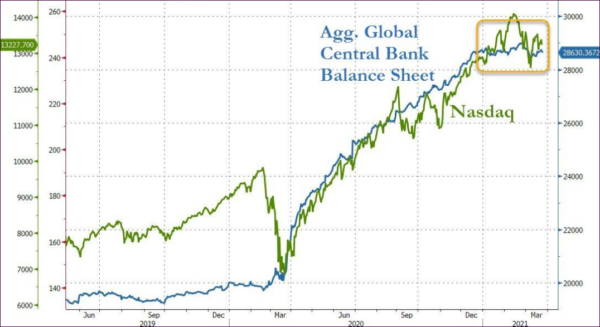

Fed Chairman Jerome Powell said the economy has recovered more quickly than expected thanks largely to stimulus and vaccines.

That will allow the central bank at some point to roll back some of its help, though he said that will happen “very gradually … and with great transparency.”

That spooked equities, which already had given a new definition to the rollercoaster name, but in the end the markets managed to crawl back out of that early hole with airlines and cruise line operators leading the rebound.

In economic news, Initial Jobless Claims fell below the 700k (to 684k) marker for the first time since the start of the pandemic. This was offset by news that the total number of Americans claiming some form of unemployment disappointingly rose last week, back above 19 million, according to ZH.

The US Dollar continued its rebound thereby taking the starch out of gold’s early leap and pulling the precious metal back into the red. Bond yields bobbed around their unchanged lines with the 10-year ending slightly higher, but the move was too small to have any effect on the markets.

I expect this type of volatility to continue and quarter-ending rebalancing to come into play for the remainder of this month.

Read More