ETF Tracker StatSheet

You can view the latest version here.

FIRST DOWN WEEK IN SIX

- Moving the markets

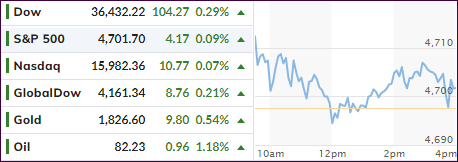

After weakness in the markets, we saw a rebound attempt yesterday, which faded into the close, but had the Nasdaq come out ahead with a 0.52% gain. This positive theme travelled through the futures market and creature a bullish opening this morning.

A little sideways bobbing and weaving set up the bullish levitation early in the day but, despite all efforts of, the major indexes closed the week down but finished this Friday on an up note.

All three major indexes posted solid gains, but the Nasdaq with an 1% advance was again the king of the hill. Still, the “hot” inflation numbers of the PPI and CPI continue to weigh on traders’ minds. However, they but now appear to be an accepted fact with the bullish theme remaining the dominant force in the face of questionable economic data.

As ZeroHedge reported, a record number of Americans just quit their jobs, as job openings surpassed unemployed workers by a record 2.8 million:

The number of quits, which for the second month in a row soared to an all-time high, jumping in September by 164K to a record 4.434 million.

As a reminder, this “take this job and shove it” indicator is generally seen as a real-time proxy of how marketable employees think they are, as they tend to quit jobs and look for higher paying occupations when the job market is red hot. And since it tends to lag peaks in job openings modestly, the surge in quits was probably not all that surprising.

We also learned that the Consumer Sentiment survey collapsed to 11-year lows due a surge in inflationary expectations. This is another nail in the coffin of the ridiculous narrative that inflation is “transitory” in nature.

After being closed yesterday for Veteran’s Day, bond yields travelled above their unchanged line with the 10-year adding almost 2 basis points to 1.573%. The US Dollar meandered aimlessly and ended just about unchanged.

Gold jumped above $1,870 this week and had its best day since June, but its potential for more gains is supported by further strength in the CPI during the upcoming months. That is, until inflation expectations become more moderate due to higher interest rates, but this may take a while to materialize.

Why?

Because the Fed will avoid raising rates if it can, because any sudden hike in bond yields, either voluntary or forced by the marketplace, will have a bearish/crashing effect on equities. And we can’t have that, can we?

Read More