- Moving the markets

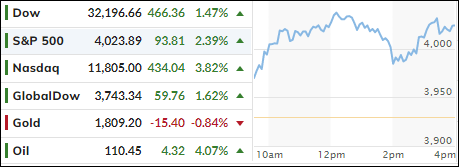

Friday’s rebound of hope found some support mid-session today, but suddenly lost steam and the major indexes headed back into the red except for the Dow, which eked out a small gain. It was another frustrating day for the bulls, with especially the Nasdaq getting hit hard again.

Trading was choppy as concerns of a slowing economy, along with higher interest rates and soaring inflation, have negatively influenced sentiment and appear to be permanent companions—at least for the foreseeable future. To no surprise, this has been a downer for all equity markets as MarketWatch pointed out:

The major averages have fallen well off their record highs. The Dow and S&P 500 are 12.3% and 16.3%, respectively, below all-time highs reached in January. The Nasdaq is squarely in bear market territory, down more than 27% from its November record.

According to ZH, the Empire Fed Manufacturing index bit the dust big time and dragged down the US Macro Surprise Index into the red for the first time since February.

Bonds rallied a bit, as yields retreated, but the moves were tiny and still aided TBF, which rallies with rising yields, to a positive close. The US Dollar tumbled, as gold advanced to recapture its $1,800 level, followed by Crude Oil, which almost touched $115 intraday.

The best performer of the day, as you might have expected in this inflationary environment, were commodities with the DBC ETF scoring a solid +1.64% gain.

Read More