ETF Tracker StatSheet

You can view the latest version here.

GAINING FOR THE DAY BUT SLIPPING FOR THE WEEK

- Moving the markets

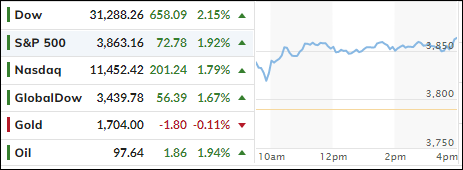

After four days of failed rebound attempts, the major indexes finally managed to squeeze out a gain for the day but ended up losing for the week in conjunction with the S&P 500 surrendering -0.92%.

Hope reigned supreme that the Fed might not deliver a full 1% interest rate hike later this month with traders wishing that we could be getting closer to the much-anticipated peak tightening.

Supporting bullish sentiment was preliminary retails sales data, which beat expectations. Also helping traders and algos alike were comments from Atlanta Fed President Bostic indicating he would “likely” not support a potentially higher rate move due to the negative influence on “undermining a lot of those things that are working well.”

On the other hand, the logic that strong retail sales could motivate a broad-based rally makes no sense to me, because that strong data point is exactly the reason for the Fed to continue its rate hikes. Otherwise, how else will they ever be able to slow down the economy and conquer inflation?

Yesterday’s ‘hot’ CPI reading of 9.1% clearly makes the case for more rate hikes. We have now a divergence with rate-hike expectations soaring and rate-cut expectations also soaring for next year, after the Fed “deepens the recession,” as ZeroHedge describes it.

Bond yields were mixed this week with only the 2-year gaining, while all others retreated slightly. After much bobbing and weaving, the 10-year closed back below its 3% level. The US Dollar continued its rampage, closed higher for the 6th week in the last 7 and ended at its highest since 2002.

Commodities tumbled for their 5th straight week, as did gold, with the precious metal testing its $1,700 level. Crude oil prices struggled as well and ended the week below $100.

In the end, the misery index says it all, since it is now at its highest since Carter was President.

Ouch!

Read More