ETF Tracker StatSheet

You can view the latest version here.

SLOPPY AND CHOPPY BUT HIGHER ON THE WEEK

- Moving the markets

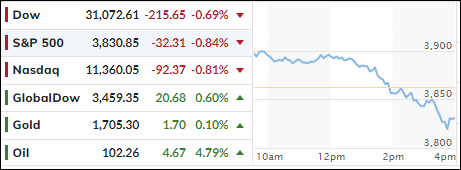

Despite a choppy and sloppy trading session, which caused the major indexes to surrender some of their recent hard-fought gains, they ended the week in the plus with the S&P 500 advancing around 2.2%.

Volatility reigned supreme, as poor quarterly results from social media darling SnapChat cut the advances of the Nasdaq short. We can expect more roller coaster rides with upside earnings surprises supporting the bullish theme, while disappointments will put the bears back in charge.

Not helping matters were a slew of analyst downgrades, which predominantly affected the tech space. Verizon was the worst performer in the Dow and dropped more than 7% due cutting its full-year forecast.

Poor economic data did not improve sentiment, because the PMI index, which measures US Service and Manufacturing, crashed into contraction mode, while the Citi Economic Surprise index continued on its southerly path. As ZH put it, we are seeing “a worrying deterioration in the economy.”

This sent market expectations for rate-hikes down dramatically for the week, with the odds of a 100bps hike next week having dropped to only 9%, as per Zero Hedge. Subsequently, bond yields dropped sharply with the 10-year losing 12 bps to close the day at 2.76%.

As yields sank, so did the US Dollar, the short squeeze simply faded into oblivion and Gold finally recaptured its $1,700 level but lost for the week.

As we’ve seen, market direction can change on a dime depending on the latest headline news, which means we will need to see much more consistent upward momentum, until our Trend Tracking Indexes (section 3) will give the go ahead to move back into equities.

Read More